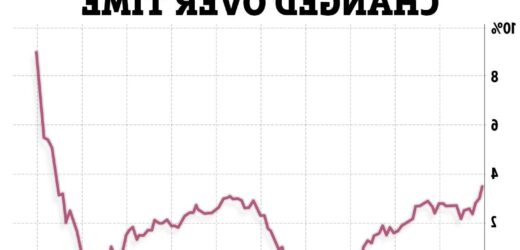

INFLATION has soared to 9% according to new data from the Office for National Statistics, squeezing household budgets.

It means the consumer price index (CPI) has hit a 40-year high since it went up from 7% in March.

Experts had predicted the figure to reach this high, which means Brits have less purchasing power than before.

But the Bank of England has already warned that inflation will climb further, and has predicted it will reach 10% within months.

Inflation is a measure of how much the prices of goods and services have changed over time.

When it goes up, prices on everyday items and essentials and bills also rise – which means you need to make the money from each month's pay-packet stretch further.

READ MORE SUN STORIES

Families will have £1,200 wiped off incomes as recession & job losses loom

Millions of workers hit by ‘real’ pay cut despite unemployment falling

Consumers are already battling rocketing energy bills along with hiked tax bills that came in last month.

And soaring energy bills were the biggest contributor to the rise in inflation, as this is the first time the data has taken into account April price cap hike.

The average household energy bill soared by 54% when the price cap increased on April 1.

But the inflation figure could be further exacerbated by another energy price cap increase in October, when the average household bill is set to go up a further 32%.

Most read in Money

BILL HELP The crucial step to take NOW to make sure you get £150 council tax rebate

I'm a savings expert – your child could have £1,000 in a SECRET bank account

Council tax rebate warning as some households won't get £150 until SEPTEMBER

I skip meals so my girls can eat as my energy bills soared to £760 a month

Chancellor Rishi Sunak said “we cannot protect people completely” from global problems which contributed to inflation hitting the 9% mark.

But "we are providing significant support where we can, and stand ready to take further action,” he continued.

Petrol prices are also contributing to inflation, which has seen its biggest annual increase on record.

Motorists have endured record prices at the pump amid a lack of supply, in part due to the ongoing Russia/Ukraine crisis.

The Office for National Statistics said the cost of food and non-alcoholic drinks had gone up by 6.7% in the year, while furniture and household equipment had risen by 10.7%.

There are mounting fears that the cost of living crisis will force more families to the brink.

Richard Lane, Director of external affairs for debt charity StepChange, said: “We need to see targeted support specifically aimed at those households whose budgets don’t have the bandwidth to absorb higher costs.

"Like people on low incomes and relying on social security for some or all of their income, and those with vulnerabilities that mean they have specific needs and cannot cut their spending in areas such as energy or food.

"These groups are already over-represented among those experiencing problem debt, and there is no time to lose if their financial situation is to be prevented from worsening drastically over the coming months.”

We pay for your stories!

Do you have a story for The Sun Online Money team?

Email us at [email protected]

Source: Read Full Article