European Parliament President calls for EU wide gas cap

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

An expert has urged the UK to limit its gas use to help fix the “underlying issues” triggering an energy crisis which has sent bills skyrocketing for millions of Britons. Russia’s war in Ukraine and Vladimir Putin’s supply cuts to Europe have shown the UK’s vulnerability to volatile gas markets. Global prices have spiralled and bill payers across the nation are struggling to foot the costs as a winter-freeze begins. This, coupled with rising inflation, means household budgets are squeezed and millions are facing fuel poverty as the average person finds it increasingly difficult to cope with the cost of living crisis.

In fact, UK inflation hit 11.1 percent, a 41-year high, earlier this year. And as a result of increased demand for oil and gas amid Russia’s invasion of Ukraine, energy prices have also soared.

While the Government has attempted to step in to ease the crisis with a £400 winter discount, a one-off cost of living payment and an energy price guarantee, Steen Jakobsen, chief investment officer at Saxo says there may be a better way to protect consumers.

He argues in Saxo’s official Outrageous Predictions that if the Government continues to try and control prices, there is potential for the cost of living crisis to get worse next year. Instead of trying to tackle inflation, which he says could possibly rise faster as a result, Prime Minister Rishi Sunak should consider power rationing to help fix the “underlying issues”.

Mr Jakobsen said: “Inflation will remain a challenge to control as long as globalisation continues to run in reverse and long-term energy needs remain unaddressed. Nearly all wars have brought price controls and rationing, seemingly as inevitable as battle casualties.

“2022 has also seen early and haphazard initiatives to manage inflation. Taxes on windfall profits for energy companies are all the rage while governments are failing to use the classic tool of rationing supplies. Instead, they are actively subsidising excess demand by capping heating and electricity prices for consumers.”

This comes after Chancellor Jermey Hunt announced in the Autumn Statement that he would increase the windfall tax slapped down on the profits of energy giants “caused by unexpected increases in energy prices”.

But he did say that the measure to increase the Energy Profits Levy from 25 percent to 35 percent would be “temporary, not deter investment and recognise the cyclical nature of energy businesses”.

The Chancellor also announced that the energy price cap would go from £2,500 to £3,00 as he scrambled to fill the £55billion black hole in the Treasury’s financing – meaning typical households won’t pay more than £3,000 a year from April. But Mr Jakobsen does not seem convinced by the measure which seeks to shield households from the full extent of increased energy costs.

He said: “In France, this simply means that utilities go bankrupt and must be nationalised. The bill is passed to the Government and then to the currency via inflation.”

And he sent policymakers in the EU and G7 a stark warning as it scrambles to slash the price of Russian gas via a price cap mechanism.

Mr Jakobsen explained: “Then we have the likely doomed effort by western officials to cap Russian energy prices from December 5. The intent is to starve Russia of revenue and hopefully cheapen crude oil export prices everywhere, but it will likely do neither.

“In a war economy, the government hand will expand mercilessly as long as price pressures threaten stability. The thinking among policymakers is that rising prices somehow suggest market failure and that more intervention is needed to prevent inflation from destabilising the economy and even society.

DON’T MISS

Outrage at Musk as firm under investigation after 1,500 animal deaths [REPORT]

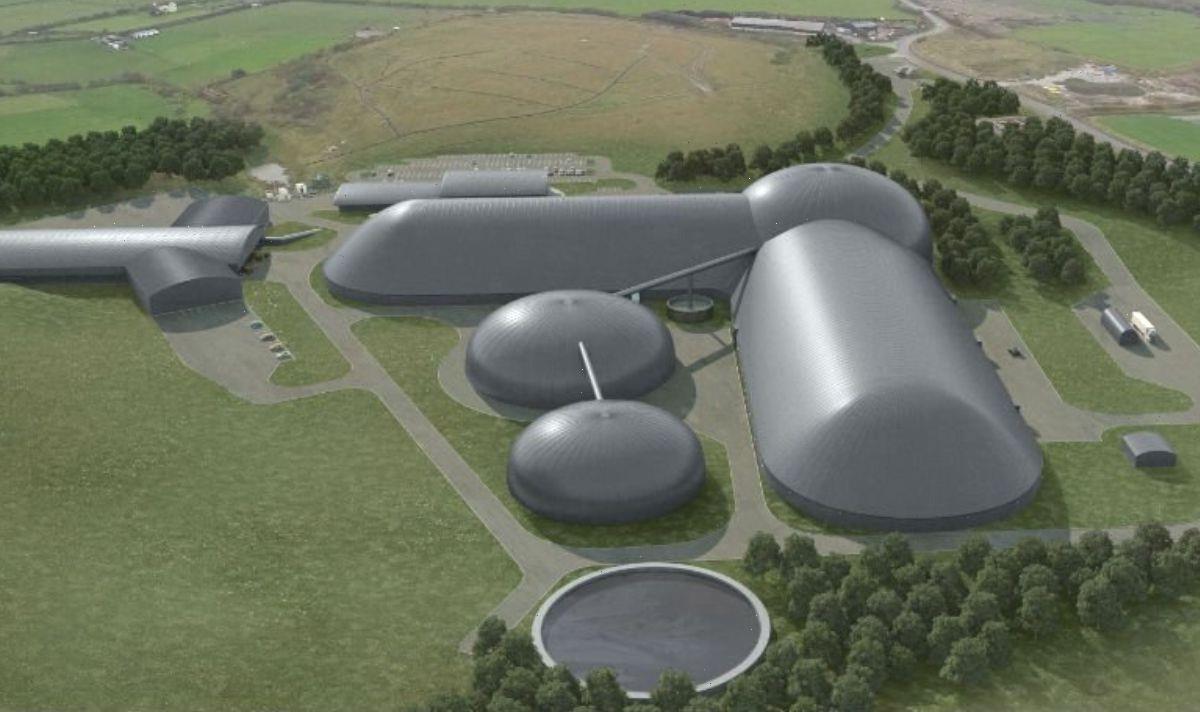

EDF offers National Grid lifeline with new site to power 100,000 homes [REVEAL]

Energy meter horror as 500,000 homes forced onto ‘expensive’ choice [INSIGHT]

“In 2023, expect broadening price and even wage controls, maybe even something like a new National Board for Prices and Incomes being established in the UK and the US.

“But the outcome will be the same as it is for nearly every Government policy: the law of unintended consequences. Controlling prices without solving the underlying issue will not only generate more inflation but also risk tearing at the social fabric through declining standards of living due to disincentives to produce, and misallocation of resources and investment. Only market-driven prices can deliver improved productivity and efficiency through investment. Looks like we’ll have to learn the lesson all over again in 2023 and beyond.”

But the UK is already encouraging households to limit energy use, and is even paying customers via a National Grid scheme that would pay people to reduce their energy consumption during peak hours to help reduce strain on the grid. It comes amid fears that the UK may not be able to shore up enough energy imports from Europe this winter, which could trigger blackouts.

To avoid this, National Grid ESO has drafted an emergency plan which, in an “unlikely worst-case scenario”, would involve three-hour blackouts rolled out across different areas around the UK to avoid a total shutdown of the grid.

The Government has been approached for comment.

Source: Read Full Article