Kohl’s is only days removed from an earnings day disaster.

The struggling mid-tier department store saw second quarter same-store sales tank 7.7% as middle-income consumers pulled back on discretionary purchases as inflation remains elevated. Gross profit margins plunged 290 basis points from a year ago. Inventory ballooned 48% from a year ago.

Execs at Kohl’s embarrassed themselves further (again) by badly slashing full year guidance to the worst amount of any big-name retailer this earnings season. Kohl’s sees full year earnings in a range of $2.80 to $3.20 a share, down sharply from a prior forecast of $6.45 to $6.85.

“Even though guidance for an approximate mid-single digit percentage comparable sales decline in second half and ~600 basis of operating margin pressure versus second half 2019 lowers the bar (and implied margin pressure in 2H is similar to 1H vs 2019), the products Kohl’s sells are all discretionary (vs Target/Walmart, which have traffic driving food/consumables), which could cause additional share loss if the consumer weakens further in the quarters ahead,” Citi analyst Paul Lejuez warned in a note to clients.

The earnings day bomb comes hot on the heels of Kohl’s failing to close a deal to sell itself amid numerous expressions of interest.

“It’s hard to imagine how inept they are,” a top Kohl’s shareholder said of current management to Yahoo Finance following the company’s latest earnings.

Amid this backdrop, Yahoo Finance visited a couple of Kohl’s stores on Long Island in New York this past weekend to get a sense of how things are going for the retailer.

What we found was that Kohl’s clearly overestimated consumer demand and could be forced to endure profit margin busting markdowns well into the holidays to clear unsold inventory. And that reality stands to hit investors once again if consumer spending doesn’t meaningfully accelerate.

We first rolled up to a Kohl’s in Bayshore, NY. Kohl’s is very proud of its new partnership with Sephora, so much so they have slapped the name on the outside of the building. Kohl’s told investors last week it sees $2 billion in sales from Sephora by 2025 as the shops open in all 1,100 locations.

The clouds were ominous, and the parking lot sparse.

As soon as we entered the store, we were greeted not by an employee — but by a clearance section. When gross profit margins fall 290 basis points in a quarter, the below picture partially explains why.

This section immediately set the tone for this particular visit.

Racks upon racks of deeply discounted apparel were seen throughout the store.

This wasn’t the only 60% off discount in this store. That level of discount was the norm on most of the clearance racks we perused.

Halfway around Kohl’s “racetrack” floor design, we were hit with another clearance section.

This was the first rack (in a long line) that we came away thinking: “There is just way too much stuff in this store, especially since it’s being borderline given away and the back-to-school shopping season has started.”

There’s so much stuff…

…that nobody wants.

Stacks on stacks!

If you are an investor in Kohl’s, realize that racks like this aren’t normal and help explain why guidance was super slashed.

This was one of the largest clearance sections in the store.

You are reading that correctly: Kohl’s is selling a $4.50 article of clothing in the clearance section. That’s 70% off the original price.

These new Sephora shops at Kohl’s are huge — way bigger than the new Ulta shops at Target — and positioned at the entrance of the store. Despite the imposing size, we didn’t see anyone in the shop in our about 20 minute visit to the store.

The shops better be jam-packed this holiday season if Kohl’s is going to reach its $2 billion sales goal for Sephora by 2025.

We then visited another Kohl’s in Jericho, NY, driving there with an open mind given that maybe the Bayshore store was an extreme version of Kohl’s struggles.

The Kohl’s + Sephora sign greets shoppers. First thought: JC Penney never had signs outside like this for Sephora. Good job Kohl’s!

More Kohl’s + Sephora signage as the company clearly wants people to buy overpriced face creams and makeup here instead of Ulta.

Any hope I had this store would be different was quickly dashed as soon as I walked in.

Similar to the Bayshore store, I was hit with a clearance rack immediately.

Sadly, this clearance rack blocks the sight line to the new Sephora shop that Kohl’s management is ostensibly prioritizing.

Another Sephora shop with no one in it. Strange.

The over-stuffed clearance racks were also on full display at this store, a clear sign Kohl’s over-estimated consumer demand.

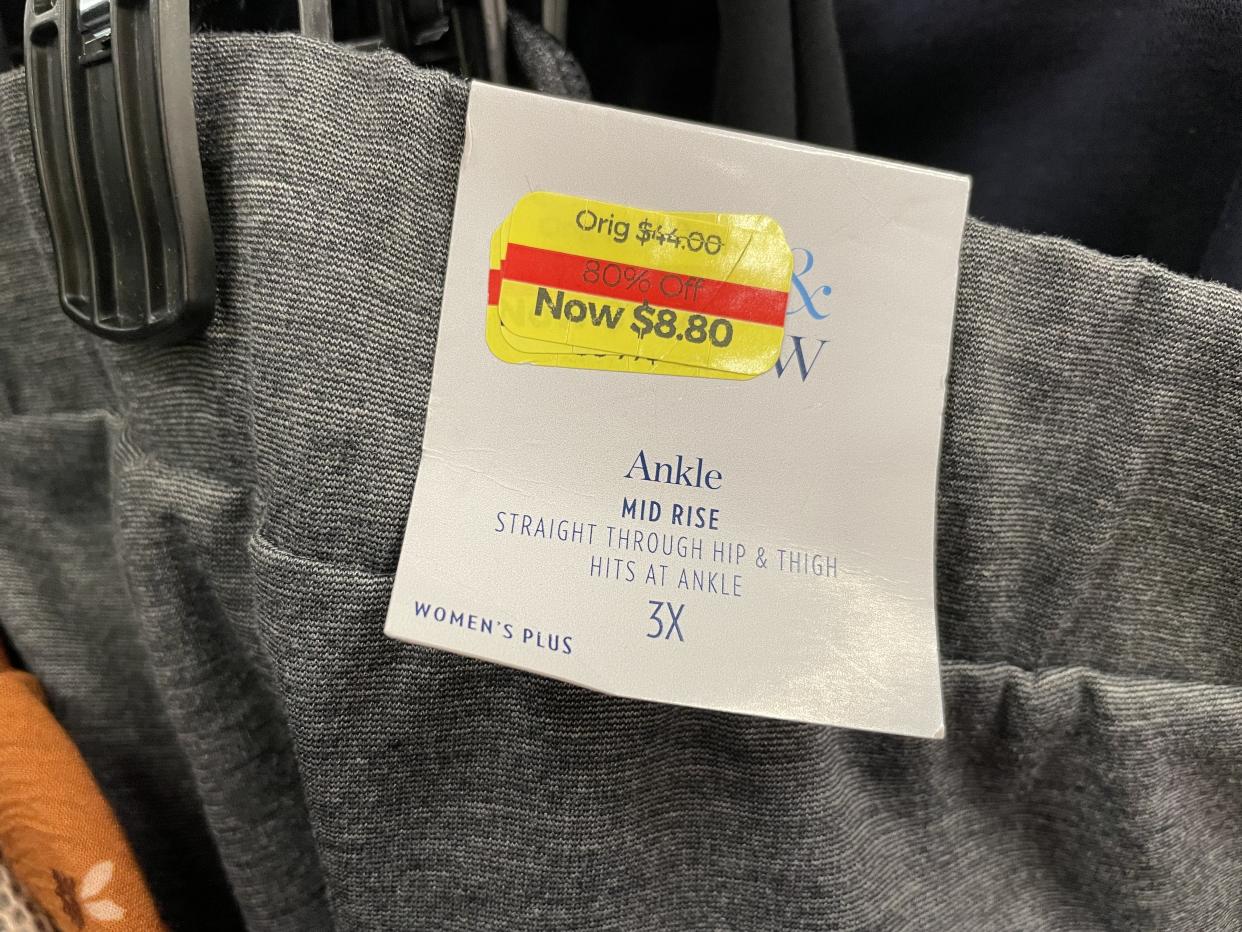

Plus-sized clothing at 80% off. When Kohl’s reports third quarter earnings, this will show up as “merchandise margin pressure” on the conference call with analysts.

It’s winter in August for Kohl’s.

In keeping with the theme that Kohl’s has too much inventor: Here are bras and shirts thrown on a random rack in the middle of an aisle in the hopes someone buys it.

One of the longest clearance racks we came across in our weekend visits to Kohl’s. In a perfect scenario, this rack isn’t here because product sold at full price.

With companies such as Marriott, Hilton and Disney reporting strong second quarters as people post-COVID revenge travel, Kohl’s being unable to sell luggage at full price is a red flag.

This photo says a lot on Kohl’s not being viewed as a top destination for travel clothing and accessories.

Unlike Bed Bath & Beyond, Kohl’s is in a relatively solid cash position. So we don’t think Kohl’s empty shelves is a sign of nervous vendors.

We wonder if the department is being properly staffed as corporate tightly manages costs with sales under pressure.

More empty shelves in the shoe department.

Thank you for reading Yahoo Finance’s actionable analysis on Kohl’s. Have a great day!

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Source: Read Full Article