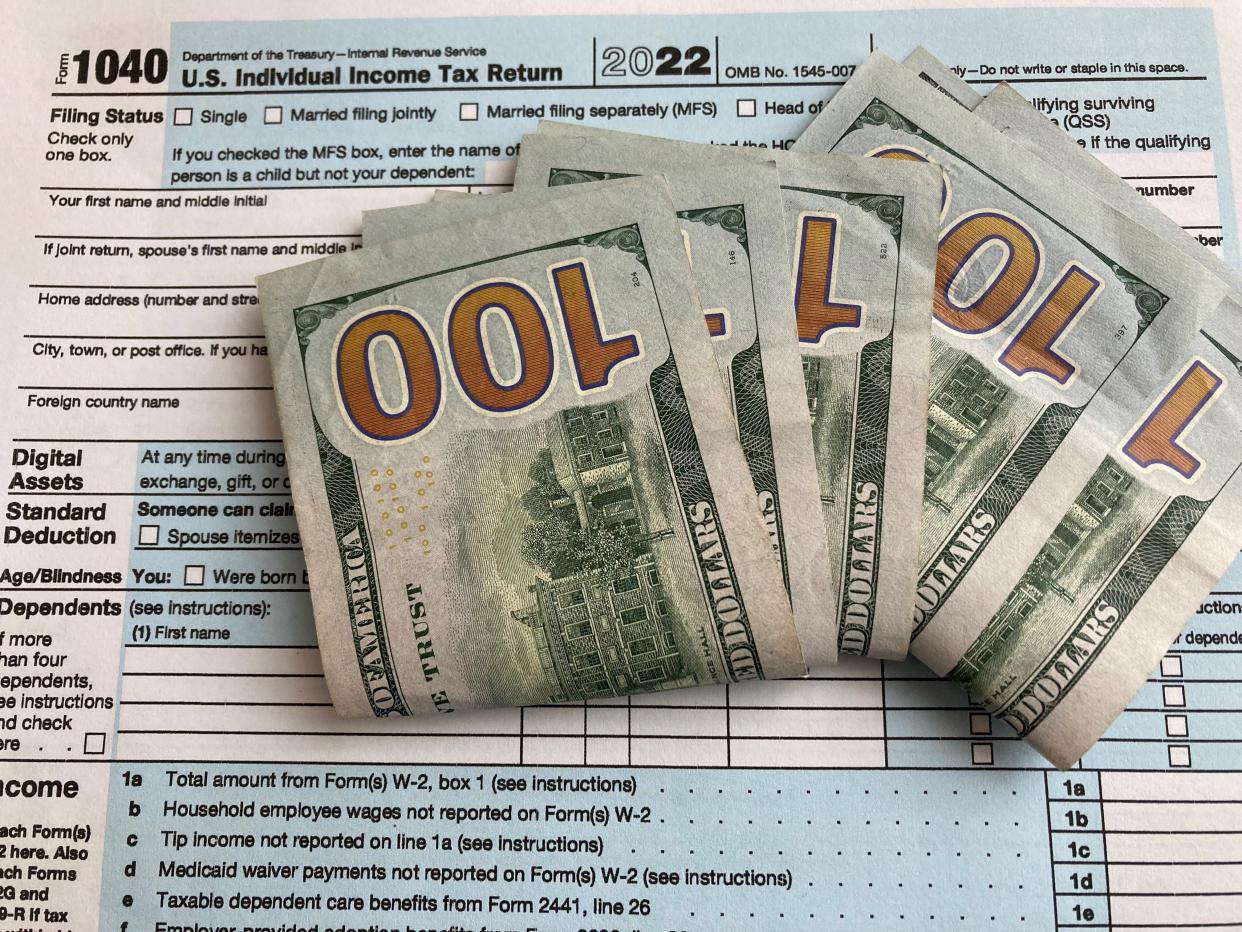

Tax refund cash already has begun hitting the bank accounts and wallets of early tax filers with the Internal Revenue Service reporting that the average tax refund so far is $1,963. But that number isn’t as exciting as a year ago.

Average refunds this year through Feb. 3 are down 10.8% from the average for the first two weeks of tax season last year.

The IRS began processing tax returns for 2022 on Jan. 23. Since then, the IRS has issued nearly $15.7 billion in federal income tax refunds through Feb. 3, based on IRS data released Friday afternoon. That’s up, amazingly, nearly 65% from a year ago.

The IRS said it has issued 7.99 million refunds – up nearly 85% from a year ago.

Yes, it is very early in the game. Federal income taxes are not due until April 18. Early filers often have simpler returns and remain eager to get tax refund cash as early as possible.

The IRS data indicated that the IRS received 18.9 million returns through Feb. 3, up 13.5% from a year ago. And the IRS said it has processed 16.7 million returns, up 29.1% from a year ago.

By comparison, nearly 13 million tax returns were processed – and 4.3 million refunds were issued – during the first two comparable weeks of the filing season last year. At that point, the IRS had received nearly 16.7 million returns through Feb. 4, 2022.

The average refund during the first two weeks of the season last year was $2,201.

What is FICA?: How much you contribute to federal payroll taxes.

IRS tax warning: IRS warns taxpayers to hold off filing returns in 20 states as it checks if it can tax special refunds

What is the current IRS backlog?

The flood of refund cash is relatively good news for taxpayers after the IRS has been besieged by bad news, including a backlog of paperwork from previous tax years.

As of a Jan. 30 update online, the IRS said it is now opening mail within normal time frames. The agency said it has “processed all paper and electronic individual returns received in 2022 or earlier.” The returns were processed in the order received, the IRS said, if they had no errors or did not require further review.

About 2.04 million unprocessed individual returns recevied in 2022 remained as of Dec. 30, 2022. The group involved 1.6 million returns that had errors to be corrected or needed other special handling and 440,000 paper returns. The IRS said it was taking more than 21 days to issue any related refunds in those cases.

As of Jan. 21, the IRS said it had 439,000 unprocessed amended returns, which can take more than 20 weeks to process at this point. The IRS stated online: “Please don’t file the same return more than once.” Taxpayers are advised to find updates at IRS.gov and use the Where’s My Amended Return? tool.

This year, the IRS is being heavily criticized for creating delays for taxpayers in more than 20 states as the IRS sorts out how special tax refunds or payments made by these states should or shouldn’t be taxed at the federal level.

The latest data for the first two weeks of this current tax season doesn’t seem to be influenced by the warnings to taxpayers in these states to wait to file until the IRS offers more guidance.

Early in the season, it has been unclear in many states what needs to be reported on the federal return and what’s considered taxable when it comes to special tax refunds or payments issued in select states last year. Advice that may be given in one state might not apply to other states that rolled out extra payments in 2022. The IRS told taxpayers Feb. 3 to wait and said guidance is on the way.

Tax season: IRS tells 21 states how to handle last year’s special payments

IRS free file options: Your 2023 guide to free tax prep services

Tax refunds expected to trend lower

Taking a quick look at early numbers doesn’t mean that more people will be seeing tax refunds or that everyone’s refund will be much lower this year than last. Weekly numbers – and the IRS does issue data on filing statistics weekly – can shift dramatically.

In general, though, refunds are expected to trend lower because several generous pandemic-related tax breaks have expired.

Faye Ball, an enrolled agent who owns The Taxlady & Co. in Wyandotte, said it’s too early in the tax season to tell how many will see a smaller refund this year. But she has worked with a few early filers who wondered why their refund was so low. Many clients, she said, have heard the warnings that have been floating around in the media for months about the possibility of smaller refunds in 2023 than 2022.

She also noted that a COVID-19-related tax change that temporarily expanded the Earned Income Tax Credit to include everyone age 18 and up has gone back to its pre-pandemic age limits and now applies only to those between the ages of 25 and 64. Working retirees age 65 and older in lower-paying jobs are likely to see smaller refunds, as a result of the inability to claim the Earned Income Tax Credit on 2022 returns.

We’re going to see more information in the coming weeks once the IRS is able to process some returns that typically benefit from generous tax credits. The IRS must wait until at least mid-February before issuing refunds involving the Earned Income Tax Credit or Additional Child Tax Credit. The 2015 PATH Act law passed by Congress provides this additional time to help the IRS stop fraudulent refunds from being issued.

The IRS “Where’s My Refund?” tool is projected to show updated status information by Feb. 18 for most early filers claiming the earned income credit and the additional child credit. The IRS expects most of these related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if taxpayers chose direct deposit.

Is Social Security income taxable by the: Here’s what you might owe on your benefits

What was the average tax refund last year?

The average tax refund was $3,252 in 2022, up 15.5% from the year before, according to the latest filing statistics data from the IRS that runs through Dec. 30. The average refund was $2,816 in 2021.

For comparison, the average tax refund was $2,549 in 2020 and $2,870 in 2019, based on December data for those years.

Who has to file a tax return: It’s not necessary for everyone. Here are the rules.

Some filers will see smaller refunds

This year, tax filers are being warned that it’s quite possible that many people will be looking at much smaller refunds than they saw last year. Pandemic-related tax breaks that no longer apply on 2022 returns include the Advance Child Tax Credit and the recovery rebate credit.

The IRS noted that data for the calendar year 2021 included more than 251,000 returns filed for individuals who did not have a filing obligation but filed to receive the Advance Child Tax Credit.

Other credits that remain may be less generous or apply to fewer people.

Best way to receive your 2023 tax refund: IRS says direct deposit. How to do it.

How changes in the child tax credit reduce refunds

Those who got up to $3,600 per dependent for 2021 for the child tax credit will, if eligible, get up to $2,000 for the 2022 tax year. For a family with two or three qualifying children, the change will be dramatic.

The American Rescue Plan had put the maximum child tax credit for 2021 at $3,000 for each child ages 6 through 17 and put the maximum at $3,600 for children 5 years old and younger.

On the 2022 returns that are being filed this year, the child tax credit is $2,000 per child under the age of 17 claimed as a dependent on your return. The child has to have lived with you for at least six months during the year. The child must be under age 17 at the end of 2022.

You qualify for the full amount of the 2022 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 or not more than $400,000 if filing a joint return. Parents and guardians with higher incomes may be eligible to claim a partial credit.

IRS may owe you from 2020 taxes: Here’s why and what you need to do to find out if you’re owed

Child care credit is smaller, too

One huge change on the 2022 return applies to those who pay for child care or dependent care so that they can work or look for work.

The child and dependent care credit falls back to a maximum of $2,100 on the 2022 tax return instead of a substantially more generous $8,000 for 2021. If you paid for child care, for example, those who qualified based on income could have received up to $4,000 in 2021 for day care expenses for one child or up to $8,000 for expenses relating to two or more children. Income limits apply to receive the credit.

The American Rescue Plan in 2021 greatly expanded the child and dependent care credit for 2021 only.

This article originally appeared on USA TODAY: Average tax refund for early filers down nearly 11% from a year ago

Source: Read Full Article