Save articles for later

Add articles to your saved list and come back to them any time.

A fortnight before Australian Trade Minister Don Farrell landed in Beijing, Chinese officials and business executives laid out the red carpet in Tianjin.

It was a flashy affair in the Shangri-La convention centre in China’s seventh-largest city. “Tesla-like,” was how one attendee described it. Rockcheck, one of China’s largest companies was celebrating the second anniversary of its merger with Tewoo, a state-owned enterprise.

It was not the only celebration that night. Rockcheck announced that after three years of bitter diplomatic and investment disputes between Australia and China, it was launching a new headquarters in Melbourne.

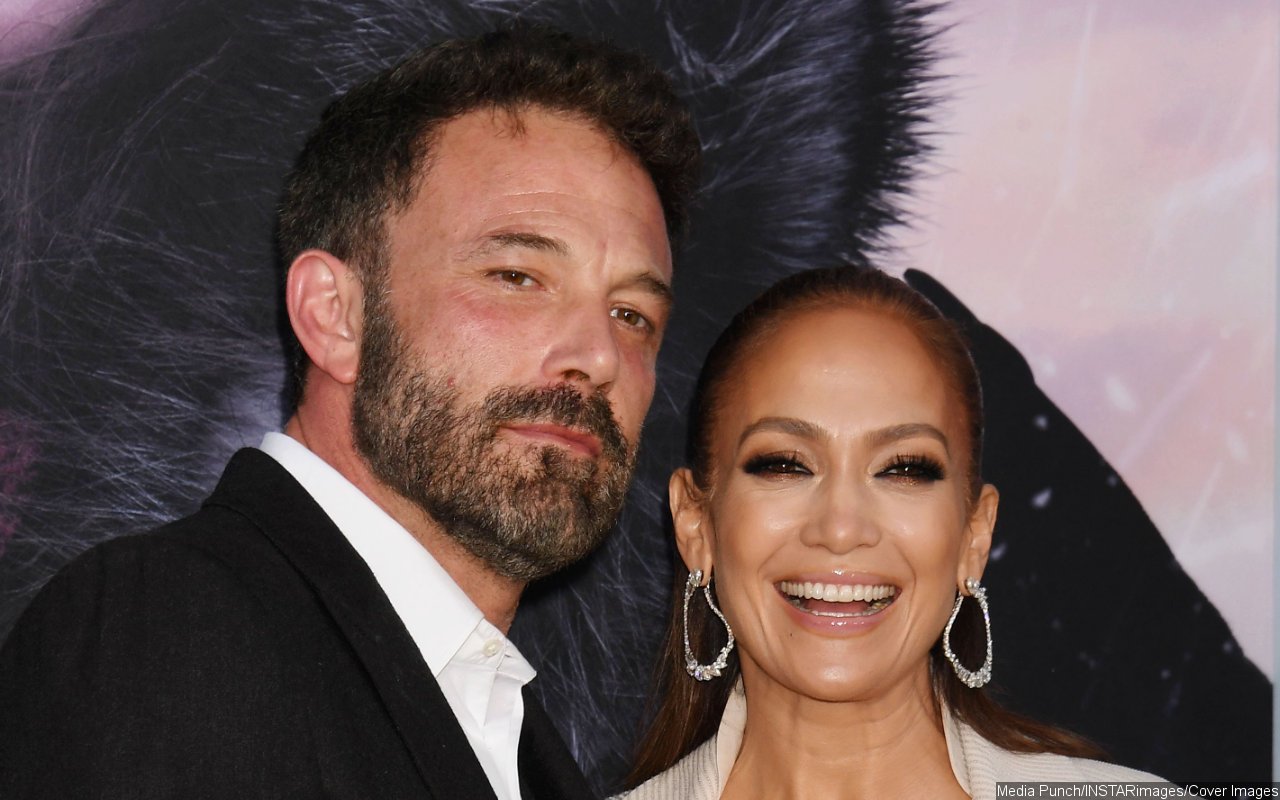

Trade Minister Don Farrell and Ambassador Graham Fletcher enjoying their flat white coffee in Beijing.

The steel, financial services, and investment conglomerate was so confident that Australia-China relations had turned a corner that it was going to set up shop in the Victorian capital.

Chinese officials and Australian businesses have been calling for a new chapter for the past year but few have put their money where their mouth is. Now some actual dollars were being spent.

Melbourne city deputy lord mayor Nicholas Reece, one of 15 members of the business and local government delegation to China, said he was delighted with the announcement.

“China is re-engaging and Australia needs to be there,” he said. “It’s hard to think of a more important international relationship for Melbourne than the relationship we have with China.”

Trade trips at different government levels to China have been steadily increasing over the past six months. To date, they have largely been symbolic. Billions of trade sanctions on Australian exports remain, along with ongoing human rights disputes over Xinjiang and Hong Kong. Two Australians, Cheng Lei and Yang Hengjun are also stuck behind bars.

From Beijing’s perspective, the tours have been successful at changing the sentiment of some Australian leaders following years of animosity and concerns about China’s authoritarian turn.

“At a time when relations at a national level have been strained these local connections are more important than ever,” said Reece

Melbourne deputy lord mayor Nicholas Reece with Rockcheck chair Zhang Ronghua in April. Credit: Nicholas Reece

On Friday, that symbolism reached its peak when Farrell was given a surprise visit to Beijing’s Forbidden City, the centre of Chinese political life for more than 500 years, before a meeting with his counterpart Wang Wentao.

“The fact that they’ve invited me here, the fact that on a Friday afternoon, the minister is giving up his afternoon and evening to meet with me and to have some discussions, I think is very, very positive,” Farrell said. “I think it augurs well for the future of our relationship with China.”

A trickle of proposed investments suggests China’s state-linked enterprises are also increasingly betting on a more stable long-term future. On Thursday, the world’s biggest steelmaker, China Baowu Group, told Farrell it would consider a massive investment in Western Australia to build a green steel mill. In February, the same company was approved for a $2 billion iron ore joint venture with Rio Tinto.

Rockcheck chair Zhang Ronghua. Credit: Rockcheck

But the Chinese giants that want to invest in this new relationship with Australia have also evolved from those that drove it to record highs before 2018. To get where it is today, Rockcheck, like many of China’s largest companies has had to deepen its relationship with the Chinese government.

The takeover deal for Tewoo in 2021 required a court-approved restructuring of its $50 billion debt. Since then, it has taken Chinese President Xi Jinping’s vision of “common prosperity” to heart and made $7 billion in social contributions and $190 million in public welfare.

Ideologically, it has tied its financial future to the party and called for all its workers to “conscientiously implement the spirit of President Xi Jinping”.

“[We will] unswervingly follow the party and work hand in hand with the party,” said its chair Zhang Ronghua, who met with Reece for drinks in Tianjin after announcing the new headquarters in Melbourne.

“The red heart is to the party, and loyalty is forged in a firm political direction. I will fully, accurately and comprehensively understand General Secretary Xi Jinping’s important thoughts on doing a good job in the party’s United Front work in the new era.”

Like many companies, Rockcheck has ridden a wave of business incentives that encourage loyalty to the party. Xi’s decade-long crackdown on corruption has wiped out faster ways to the top.

Research in the Journal of Institutional Economics found companies that have political connections to the top of the party receive on average 16 per cent higher subsidies from the Chinese government.

“Connections in the private sector act as a door to resources that would be difficult to obtain otherwise,” said researchers Marta Alonso, Nuno Palma, and Beatriz Simon-Yarza.

Rockcheck and Zhang were contacted for comment.

Australia’s security agencies have been grappling for the past decade with how to manage China’s fusion of commercial and government interests.

Farrell now believes some of those concerns can be separated.

“There’s no reason why we can’t progress our national security and our national interests but also continue our trading relationship,” he said.

With Tom McIlroy and Ben Packham

Get a note directly from our foreign correspondents on what’s making headlines around the world. Sign up for the weekly What in the World newsletter here.

Most Viewed in World

From our partners

Source: Read Full Article