Could Bitcoin crash make El Salvador go BUST? Government has already lost $40m amid plans to build crypto city

- The crypto losses are equal to Central American country’s next bond payment

- President tweeted plans for a Bitcoin-powered smart city on Tuesday

- El Salvador became the first country to accept Bitcoin as legal tender last year

- Bond markets doubt the country’s ability to service its debts due to the losses

El Salvador’s Bitcoin bet could be putting the country in peril as its holdings have already lost $40m in amid a cryptocurrency rout.

The losses – equal to the Central American country’s next bond payment – come amid a so-called ‘crypto winter’ and the president’s plans to build a volcano-powered ‘crypto city’ to mine bit coin.

President Nayib Bukele announced in September that El Salvador would become the first country in the world to accept Bitcoins as legal tender and forked out $105 million on the digital currency.

But since then its value has fallen 45% amid a general bursting of the crypto bubble, slicing the value of the 2,301 Bitcoins bought by state coffers down to $66 million.

The decision to make Bitcoin legal tender has nonplussed bond investors, who see it as exposing the state coffers to the volatility of the crypto market and thus hitting the country’s ability to make bond payments.

‘It’s risky because it’s an extremely volatile asset, and it’s an investment that is totally at the discretion of the president,’ Bloomberg report former El Salvador Central Bank Chief Carlos Acevedo as saying.

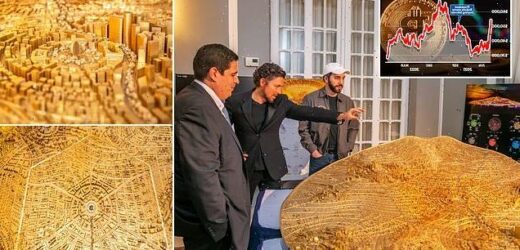

El Salvadorian president Nayib Bukele (left, in the cap) has unveiled architecture studio FR-EE’s designs for a cryptocurrency-funded city that is planned to rise up the side of a volcano in the south of the country

President Nayib Bukele announced in September that El Salvador would become the first country in the world to accept Bitcoins as legal tender

The decision to make Bitcoin legal tender has nonplussed bond investors, who see it as exposing the state coffers to the volatility of the crypto market and thus hitting the country’s ability to make bond payments

El Salvador President Nayib Bukele forked out $105 million on the digital currency. But since then its value has fallen 45% amid a general bursting of the crypto bubble, slicing the value of the 2,301 Bitcoins bought by state coffers down to $66 million

The self-described ‘coolest president in the world’ Nayib Bukele (above) is a strong proponent of the cryptocurrency Bitcoin

‘He buys it on his phone when he wants to take advantage of the dip, but he doesn’t do it right because when he buys there’s always a bigger dip.’

El Salvador owes bondholders $382 million in interest this year, with July being the heaviest month for payments as $183 million comes due.

The nation has $3.4 billion in reserves in April, according to the central bank, and there are plans to raise $1 billion through a Bitcoin-backed bond, although given the collapse of the cryptocurrency’s value this is now in doubt.

Despite these reserves, markets now seriously doubt El Salvador’s ability to service its debt due to its dalliance with cryptocurrency.

Ratings agency Fitch downgraded El Salvador’s debt to CCC, or ‘junk’ in the industry, worrying that increasing debt to GDP levels, expected to hit 86.9% in 2022, ‘increases concerns around debt sustainability over the medium term.’

Bukele has maintained his enthusiasm for the digital currency even as its price plummets, having double-downed with the purchase of another tranche of 500 bitcoins on May 9 for $15.5 million – now valued at $14.1 million just four days later.

On the same day, he tweeted lavish architectural plans for a ‘crypto city’, a lush and green sci-fi vision of a megalopolis on the coast complete with landmarks and an airport.

Bukele has maintained his enthusiasm for the digital currency even as its price plummets, having double-downed with the purchase of another tranche of 500 bitcoins on May 9 for $15.5 million – now valued at $14.1 million just four days later

The lavish architectural plans for a ‘crypto city’ a lush and green sci-fi vision of a megalopolis on the coast complete with landmarks and an airport

The plans for Bitcoin City put its construction – the start date of which is unclear – near the Conchagua volcano on the Gulf of Fonseca in the south-east of the Central American country

‘Trees everywhere,’ he said on Twitter. ‘With a beautiful lookout in the volcano.’

The plans for Bitcoin City put its construction – the start date of which is unclear – near the Conchagua volcano on the Gulf of Fonseca in the south-east of the Central American country.

Nayib Bukele – The first millennial dictator?

Nayib Bukele, the 40-year-old self-described ‘coolest president in the world’, has been developing a new form of authoritarianism that other savvy democratic leaders may soon adopt.

Since the start of May he and his supporters have made classic authoritarian moves to cement their hold over power and neuter democracy.

On May 1 he fired the country’s top prosecutor and the highest court, packing both institutions with loyalists.

Since then he has used state agencies to harass journalists, investigate political opponents and dismantle government checks and balances.

He is also drafting a new constitution.

He has explicitly stated that his mission is to ensure that his opponents never return to power.

Yet he retains over 80% popular support in polling.

He has seemed to achieve this by positioning himself as the antidote to El Salvador’s notorious and endemic corrupt establishment – the opposition he wishes to never return to power.

He has deliberately appealed to the illiberal tendencies of younger voters disillusioned with democratic politics that have produced decades of corruption.

They prefer to have an authoritarian leader who represents their interests.

First proposed in 2001, it is slated to be a ‘smart’ city fully-based on the use of Bitcoin as the digital currency, where the citizens will be free from most taxes.

‘We will have no income tax, forever. No income tax, zero property tax, no procurement tax, zero city tax, and zero CO2 emissions,’ Bukele said in a statement in November.

‘The only taxes that they will have in Bitcoin City is VAT, half will be used to pay the municipality’s bonds and the rest for the public infrastructure and maintenance of the city.’

El Salvador has struggled with which currency to use over the years. It abandoned its own volatile fiat currency – and thus control over its own monetary policy – in favour of the US dollar in 2001.

The move to Bitcoin was intended to help the citizens of the country relying on remittances from the USA and other countries avoid the notoriously predatory services that the money had to pass through.

The government developed an app called Chivo Wallet to facilitate daily crypto transactions with a $30 giveaway to citizens who downloaded it to promote its use.

But only 20% of users continued to use it after spending the giveaway, with the volatility that makes crypto such an attractive unregulated security making it a poor day-to-day currency.

The nation was in talks with the International Monetary Fund over an extended fund facility to help it weather the recent turmoil, but these stalled over Bukele’s decision to make Bitcoin legal tender.

Since then, the spreads on the nation’s credit default swaps – a type of insurance against missed payments – have risen more than 20 percentage points, implying an 87% chance of a default in the next five years.

El Salvador’s travails come against the backdrop of plunging in values in digital currencies across the board in a so-called ‘crypto winter’ that has lost investors billions.

More than $200billion has been wiped off the cryptocurrency market yesterday alone.

During the pandemic, record low interest rates intending to boost economies led to investors buying riskier assets like cryptocurrency with higher rates of return.

As skyrocketing inflation leads to a rise in interest rates in order to safeguard savings, these assets are being sold in favour of safer government bonds – which will provide better returns.

Source: Read Full Article