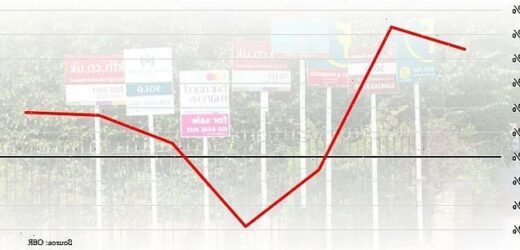

Economic forecasters predict house prices will plummet by 5.7 per cent in 2024 and sales will fall by a FIFTH in a blow to homeowners as the economy struggles to keep afloat

House prices are set to tumble by almost six per cent next year in another blow for homeowners.

The Office for Budget Responsibility said that a 1.1 per cent dip in prices expected this year would steepen in 2024 to a maximum of 5.7 per cent.

With interest rates not expected to fall much below 4 per cent for some time as economists seek to bring down inflation, it will add to pressure on mortgage-holders looking to refinance in the next 12-24 months.

The OBR said it now believed prices would fall 10 per cent from their high in the fourth quarter of last year, up from a predicted 9 per cent in November.

It also expects house sales to dip by 20 per cent as families decide to stay put and wait for prices to rise.

The Liberal democrats called for a Mortgage Protection Fund ‘to protect families and pensioners from the Government’s spiralling rates.’

Lib Dem Levelling Up, Housing and Communities spokeswoman Helen Morgan said: ‘For millions of families and pensioners this Budget is Jeremy Hunt’s house of horrors.’

Levelling Up, Housing and Communities spokeswoman Helen Morgan said: ‘For millions of families and pensioners this Budget is Jeremy Hunt’s house of horrors.

‘People are seeing their house prices tumble, yet support from the Chancellor is nowhere to be seen.’

In its analysis today the OBR said: ‘Our central forecast is that house prices fall by 10 per cent from their high in the fourth quarter of 2022, a 1 percentage point larger fall than in our November forecast.

‘Property transactions are expected to drop by 20 per cent relative to their peak in the same quarter.

‘Leading indicators from Halifax and Nationwide suggest that house prices have already fallen by 3 to 6 per cent between their peak in the middle of 2022 and February 2023.

‘Low consumer confidence, the squeeze on real incomes, and the expectation of mortgage rate rises to come are expected to contribute to continued falls in house prices and a reduction in housing market activity.’

Source: Read Full Article