LV boss defends £530m sale of historic UK insurer to US private equity firm as ‘only deal that secures our future’ despite fury at raid

- Politicians have united to condemn the buyout of LV by US firm Bain Capital

- Takeover means 178-year-old insurer will no longer be owned by 1.2m members

- In impassioned plea, Lord Heseltine urged LV members to vote against the deal

- Private equity firms spent £33bn snapping up UK firms in first half of this year

The boss of historic British insurer LV has insisted the mutual’s controversial sale to private equity is the ‘only deal that secures our future’ as he faces mounting criticism from politicians and policyholders over the move.

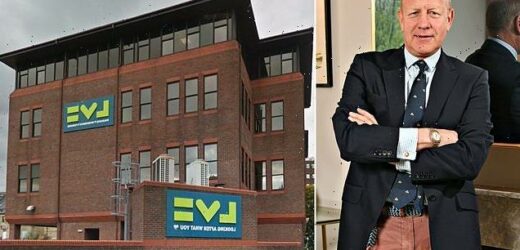

Mark Hartigan, chief executive of LV, told the BBC’s Today programme the 178-year-old insurer’s £530 million sale to US firm Bain Capital was the ‘best financial outcome’ for members.

The sale has taken centre stage as politicians from across the spectrum have united to hit out at the deal, which would see LV lose its status as a mutual.

With one month to go until members vote on the deal, concerns are growing over the group’s future in the hands of a private equity firm and the payouts being offered to members, as well as the motives behind the sale.

Mark Hartigan, chief executive of LV, told the BBC’s Today programme the 178-year-old insurer’s £530 million sale to US firm Bain Capital was the ‘best financial outcome’

Mr Hartigan defended the decision to back the Bain bid and urged members to vote for the sale next month.

He said: ‘It’s the only deal that secures our future.’

‘This is a very important brand and important British business, and it’s the only bid that secures it.’

LV – formerly Liverpool Victoria – was founded in 1843 to allow Liverpool’s poor to cover burial costs. It is currently owned by its 1.2 million customer members.

Under the deal, they would hand over ownership of the group and receive £100 each while with-profits members will be given an additional boost when their policies mature.

Some members have dismissed the payout as being ‘paltry’.

LV’s board agreed to the Bain capital deal after receiving around a dozen expressions of interest, including a bid from rival Royal London that is thought to have been for £10 million more than Bain.

LV has not disclosed the value of the Royal London approach.

The All Party Parliamentary Group for mutuals wrote a letter to the Financial Conduct Authority earlier this week demanding it release more details surrounding the Bain sale and rival bid interest.

Former deputy prime minister Lord Heseltine has also criticised the deal, urging members to veto the sale.

But Mr Hartigan said Bain was the ‘only business prepared to invest in our growth’.

‘That means saving the jobs that we have and the sites that we operate in,’ he added.

He stressed that all options on the table would have seen LV lose its mutual status.

Members will be asked to have their say on December 8 or at an online meeting on December 10, with 75% of votes needed to back the takeover and a minimum turnout of 50%.

Tthere are concerns LV is also planning to push through a rule change that will mean it can override the minimum turnout threshold.

Mr Hartigan told the BBC he would ‘100%’ respect the outcome of the vote.

He also denied reports that management had backed the Bain deal because of guarantees to secure their roles.

‘There’s no incentives related to the deal for me or anyone else – the chairman, the board or any part of our management team,’ he said.

More than 400 people have now signed a petition on change.org calling for City regulators to stop the demutualisation of LV.

LV members can vote against the deal online before December 8 or at a special meeting on December 10. While LV bosses line up for bumper pay packets after the deal, the policyholders who own the company will get just £100 each (file photo of company’s Bournemouth offices)

One member who joined the online petition, branded the plans a ‘betrayal for members’.

‘I don’t want my savings to create profits for Bain Capital,’ she added.

In an impassioned plea, Lord Heseltine urged LV members to vote against the deal next month. ‘You can vote for the original concept and remain as owners yourselves,’ said the Tory peer. Private equity firms spent an unprecedented £33billion snapping up British firms on the cheap during the pandemic in the first half of this year.

Ed Miliband, Labour’s business spokesman, also urged members to oppose the deal. ‘I am deeply concerned at the details of the proposed takeover and demutualisation of LV by Bain Capital,’ he said.

‘I urge members to make their voices heard during this process and protect their best interests. The Government should be doing everything it can to grow our mutual and co-operative sector.

‘Instead, it’s another example of leaving our firms dangerously exposed to takeovers that strip assets, lose jobs and weaken our national economy.’

Critics of the Bain takeover of LV have raised concerns over:

- Job losses among LV’s 1,500 staff in Bournemouth, Exeter and Hitchin;

- LV refusing to disclose details of a rival offer from fellow mutual Royal London, believed to have been £10million more;

- Bosses Mark Hartigan and Alan Cook’s repeated claims that they will not profit personally from the sale;

- A rule change that will see LV bosses try to scrap an article of their mutual constitution to make it easier to force through the sale;

- Mr Cook’s role in the Post Office scandal where he oversaw the first prosecutions of sub-postmasters who were wrongly accused of theft.

LV’s board agreed the £530million deal with Bain in December last year after sounding out offers from 12 potential buyers. Bosses said the private equity firm offered an ‘unrivalled commitment’ to LV’s future. But it emerged they had planned a change in the rules to secure members’ approval, which Lord Heseltine called ‘reprehensible’.

Bosses admitted they would not meet the 50 per cent voter turnout required by LV’s constitution so will put forward a second vote at the same time asking them to scrap the rule.

Mr Hartigan and Mr Cook plan to stay on if the deal goes through – other offers would have seen them lose their jobs. The former is likely to be handed an equity stake potentially worth millions and his salary would be significantly higher than the £1.2million he was paid last year.

In an impassioned plea, Lord Heseltine urged LV members to vote against the deal next month. ‘You can vote for the original concept and remain as owners yourselves,’ said the Tory peer

Mr Cook has said he will receive ‘no bonuses or incentives’ as part of the deal, but he will retain his £205,000-a-year role for at least two more years.

Bain has made no guarantees about jobs, but has said it will keep a presence in all three current bases.

Gareth Thomas, who chairs parliament’s cross-party group on mutuals, urged members to block the deal. The Labour MP said: ‘If members do not get out and vote against this deal in huge numbers, we could see another historic British firm fall to private equity vultures.’

Sarah Olney, Lib Dem business spokesman, said: ‘This potential takeover is highly concerning, both for LV itself and for what it means for British business. It’s even more worrying that the deal seems to rely on the rewriting of company rules.’

The Green Party said that LV bosses were acting like ‘carpet-baggers’.

Finance spokesman Molly Scott Cato said: ‘Whether or not they stand to gain personally, it looks as if they have a strategy of bribing current owners with their own money.’

An LV spokesman said: ‘While none of the bids would have allowed LV to remain as a standalone mutual, this deal provides the highest distribution to with-profits policyholders compared to continuing with ‘business as usual’ or closing to new business.’

In a letter to LV members, Bain’s Matt Popoli said: ‘We are looking forward to investing in LV and its people for the long term, to preserve and grow the LV heritage into the future for the next generation of customers.’

Source: Read Full Article