It’s time to pull out Jimmy McMillan’s slogan for his 2010 New York mayoral run: “The rent is too damn high.” But today, the slogan applies across the country as renters feel the squeeze.

The median monthly rent in May hit $1,849, a 26.6% increase since 2019 before the pandemic, according to Realtor.com’s Monthly Rental Report.

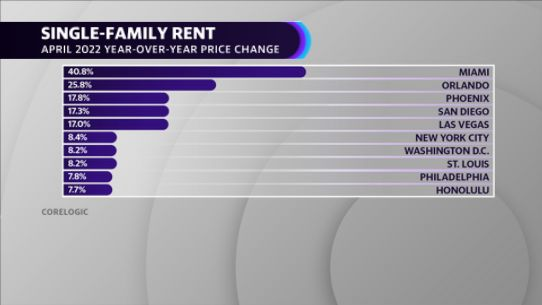

“Single-family rents continue to increase at record-level rates,” Molly Boesel, principal economist at CoreLogic, said in a statement regarding its Single-Family Rent Index (SFRI) report. “In April, rent growth provided upward pressure on inflation, which rose at rates not seen in nearly 40 years. We expect single-family rent growth to continue to increase at a rapid pace throughout 2022.”

During the pandemic, rent moratoriums and rent assistance programs helped renters who were laid off stay in their apartments. With the expiration of those programs, rent affordability is becoming a crisis with rising inflation.

Where you live will determine the amount of your rent hike. In Miami, rent increases are averaging 40.8% with Orlando seeing increases of 25.8% and Phoenix 17.8%.

“Rent and for-sale listing prices are closely correlated,” according to Realtor.com’s report. Therefore, it’s not surprising that rents are high in Miami and Phoenix, as both cities typically lead in S&P CoreLogic Case-Shiller national home price 20-city index.

New Yorkers are complaining about 40% rent increases, with the average rent on a (non-subsidized) apartment in May was $4,975 a month, a 22% from last year.

For rent-subsidized New Yorkers, the New York City housing board voted to increase rent for rent-stabilized homes 3.25% for one-year leases and 5% for two-year leases.

“There’s no question that renters are facing sky high prices. And with rising inflation reflecting price jumps for both rents and everyday expenses, many renters are feeling the strain on their finances,” Danielle Hale, chief economist at Realtor.com, said in a press release. In a bit of good news for renters, last month’s prediction of rents surpassing $2,000 sometime this summer is going to take longer to materialize.”

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government.

Follow her on Twitter @writesrondaRead the latest personal finance trends and news from Yahoo Money. Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.

Source: Read Full Article