You CAN spike the hike: Rishi Sunak is urged to axe ‘worst-timed tax rise in history’ as it emerges he might have a £50bn to ‘play with’ even without national insurance increase

- Rishi Sunak faces renewed calls to axe national insurance hike in mini Budget

- Business leaders and MPs say the Chancellor now has significant ‘wiggle room’

- £12billion rise comes as families struggle to cope with the cost-of-living crisis

- The hike has been branded by experts as ‘the worst-timed tax rise in history’

Rishi Sunak faces renewed calls to spike his national insurance hike in tomorrow’s mini-Budget – as surging tax revenues leave him with ‘up to £50billion to play with’.

Business leaders and Tory MPs say the Chancellor now has significant ‘wiggle room’ to postpone next month’s £12billion rise.

With families struggling to cope with the cost-of-living crisis, the rise has been branded by experts as ‘the worst-timed tax rise in history’.

But official figures yesterday revealed tax revenues are pouring into the Treasury again as the economy recovers from Covid. VAT revenues hit an all-time high, as did takings for other taxes including stamp duty and inheritance tax.

Soaring revenues have helped slash government borrowing – with new figures yesterday suggesting it will come in around £30billion less than forecast.

Sir Charlie Bean, who was in charge of economic forecasts at the Office for Budget Responsibility until December, said the improving picture left the Chancellor with substantial ‘wiggle room’ to help families struggling with soaring bills.

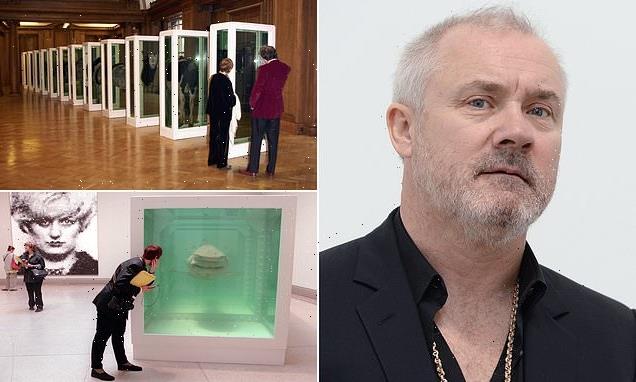

The Chancellor Rishi Sunak runs through his Spring Statement speech in his offices in 11 Downing Street

He suggested Mr Sunak had somewhere between £25billion and £50billion ‘to play with’.

The Treasury said last night that the Chancellor would use today’s statement to ‘outline further plans to help with the rising cost of living’.

Mr Sunak, who originally planned to avoid any major new spending commitments, will say he is ready to ‘stand by’ hard-pressed families.

He is expected to make pledges totalling at least £10billion, including a temporary cut in fuel duty of up to 5p a litre, increases in national insurance thresholds and increases to working-age benefits.

But, in remarks released last night, the Chancellor warned that economic turmoil caused by the war in Ukraine underlined the case for strengthening the public finances rather than spending all the windfall tax revenues.

He said the challenge to the West posed by Russia would be met ‘not just in the arms and resources we send to Ukraine but in strengthening our economy here at home’.

Mr Sunak is on course to become one of the biggest tax-raising chancellors in history, with official forecasts predicting the tax burden will rise to 36.2 per cent of GDP over the next five years.

Speaking at the weekend, he bridled at the figures, pointing out that the massive cost of the pandemic had left him with no choice but to raise taxes. Mr Sunak said he was on a ‘mission’ to cut taxes.

The Chancellor is understood to be targeting a cut in the basic rate of income tax before the next election. Some senior Tories believe he could even announce the intention today to divert attention from the huge tax rises due to come into force next month.

But Tory MPs last night urged him to cut taxes immediately – or risk slowing the recovery.

Steve Baker, a member of the Commons Treasury committee, said: ‘We should be cutting taxes now – it is what the economy needs. In particular, we should be halting the rise in national insurance, which is a tax on jobs and a tax on the young to pay for the healthcare of the old.’

Former Cabinet minister Sir John Redwood also called for the national insurance rise to go as part of a £20billion package of tax cuts. ‘The Chancellor says he is a tax-cutter by instinct, which is good to hear. But now is the time to show it – a tax-cutting Chancellor would be cutting taxes now.’

Rishi Sunak faces renewed calls to spike his national insurance hike in tomorrow’s mini-Budget

Former Sainsburys boss Justin King also said the NI hike ‘should not go through’.

He told the BBC that inflation could rise to 10 per cent this year, adding: ‘The real cost-of-living crisis has yet to arrive. Next month the rise in energy bills will hit people hard, closely followed by the rise in NI… in my view the NI rise should not go through.’

Even Labour called for the NI rise to be ditched, with Sir Keir Starmer saying it would be ‘cynical’ to raise taxes on working families now in order to raise funds to cut taxes before the election.

The appeals came as:

- Treasury insiders warned that official inflation forecasts would be upgraded and could get close to 10 per cent;

- Ministers said prescription charges would be frozen to help ease the cost-of-living crisis;

- Environment Secretary George Eustice warned that food prices could rise another eight per cent;

- A YouGov survey found twothirds of voters think the Government is ‘handling taxation badly’.

Figures released by HM Revenue and Customs yesterday have put the Chancellor under growing pressure to cut taxes now.

They revealed tax revenues in the financial year to date are up by £132billion on the same period last year.

Officials said the impact of the pandemic meant the figures could not be compared directly.

But several key taxes hit record levels. Inheritance tax raked in a record £5.5billion in the financial year from April to February, smashing through the previous record of £5.4billion for the 2018/19 tax year.

Stamp duty pulled in £18billion, up from the previous record of £16.4billion after a year of red-hot activity in the property market.

And VAT receipts are £23.8billion larger than the same time last year, at £150.2billion. Improved revenues have also led to a sharp falling in government borrowing.

Britain has borrowed £138.4billion in the financial year so far, with one month left to go, according to data from the Office for National Statistics.

This is less than half the £290.9billion of borrowing which the Government racked up over the same time a year earlier, when Mr Sunak

Taxing jobs is the economics of the madhouse

By Alex Brummer, City Editor for the Daily Mail

The cost of living is soaring – filling up the car and buying food at the supermarket is becoming more expensive by the day, while a sharp hike in energy bills is imminent.

With mortgage and borrowing costs also on the rise, the inflationary background to Rishi Sunak’s Spring Statement today could hardly be more stark.

The Chancellor insists he will ‘stand by’ hardworking families. Here’s how he can achieve that while encouraging wealth creation and making Britain the high-skills, high-pay economy we all want it to be.

The simplest way of easing inflation would be to consign to the dustbin the national insurance increase of 1.25 percentage points – forecast to raise £14billion in 2022-23 and designed to help clear the NHS waiting list and fund social care.

Taxing jobs when the country faces rising prices and a potential slump – something that has followed almost every previous energy crunch – is the economics of the madhouse.

Thanks to falling unemployment, receipts from self-assessment have soared by almost 22 per cent over the past 11 months, while income tax from those on payrolls has jumped by almost 14 per cent to £170billion – way ahead of last year’s £150billion.

The NI hike may have looked necessary last September before the jobs market took off. It is not anymore. Another way is for Sunak to rethink the corporation tax rise.

This is due to rise from 19 per cent to 25 per cent in 2023 in another effort to balance the budget. But lower corporation tax rates pay for themselves.

In 2009-10, the levy stood at 28 per cent and receipts were just over £40billion.

But in 2020-21, with the tax down to 19 per cent, receipts soared to almost £55billion – in spite of Covid.

It’s a celebrated paradox: the lower the taxes, the greater the profit incentive and the more tax generated.

Sunak also plans to incentivise companies to invest more by offering more tax breaks for Research and Development. No one could argue with that. But he needs to go much further and keep the headline rate competitive.

And to ease the cost of living crisis, the temporary VAT cuts for hospitality introduced during Covid should be reinstated.

Britain’s hospitality industry is still reeling from the pandemic and now inflation means that many customers will stay at home because of rising prices.

Cutting the VAT on energy bills, a Labour Party proposal, could also help and release cash for spending elsewhere.

As for fuel duty, the Chancellor’s suggested 5p cut per litre will help – but looks measly given the prices at the pumps. Sunak should also reform business rates. These are deeply unfair.

As more sales have moved to the online giants, the burden on local shops and businesses has caused desolation on high streets. What is needed is a new ‘micro-charge’ added to every online sale.

Meanwhile, during Covid, cutting stamp duty to 0 per cent on homes costing up to £500,000 helped both to stimulate deals and provide an unexpected 70 per cent boost to the Exchequer.

Sunak should reintroduce the stamp-duty holiday to stimulate the market and encourage transactions. And finally, the Chancellor should encourage wealth creation.

There is a tendency in Britain, particularly on the Left, to abhor dividends, bonuses and gains from entrepreneurship.

But taxes on dividend income, capital gains and inheritance are critical to funding public services. We should be encouraging enterprise and entrepreneurship by making it clear wealth will not be penalised.

Source: Read Full Article