Russia is on the brink of defaulting on its debt for the first time since the Bolshevik Revolution more than a century ago as Western sanctions for Putin’s invasion of Ukraine bite

- Russia is unable to make payments from US bank accounts after latest sanctions

- Instead this week it tried to make a foreign dollar bond payment in roubles

- Credit ratings agency S&P downgraded Moscow to ‘selective default’

- Sanctions are likely to be further increased as new war crimes come to light

- Russia has a 30 day grace period to find the dollars or officialy be in default

Moscow is on the brink of defaulting on its debt for the first time since the Bolshevik coup more than a century ago as sanctions begin to take their toll on the Russian economy.

Credit ratings agency Standard & Poor downgraded Moscow from ‘junk’ to ‘selective default’ on Friday after Russia tried to make foreign bond payments in roubles on Monday when they were due in dollars.

Putin’s government is unable to make dollar payments from accounts held at American banks after the US Treasury stepped in to halt them in the latest wave of sanctions imposed on Russia for invading Ukraine.

S&P said in a statement that its decision was based partly on its opinion that sanctions on Russia ‘are likely to be further increased in the coming weeks, hampering Russia’s willingness and technical abilities to honour the terms and conditions of its obligations to foreign debtholders’.

The Kremlin has warned that while it is willing to pay its foreign debts, it would do so in roubles so long as its overseas accounts in foreign currencies remain frozen.

Russia still has a 30 day grace period in which to convert the rouble payment into dollars or find some other way to avoid officially going into default.

Vladimir Putin (pictured) is facing the prospect of Russia’s first sovereign debt default in over a century after Moscow attempted to make a bond payment that was due in dollars in roubles

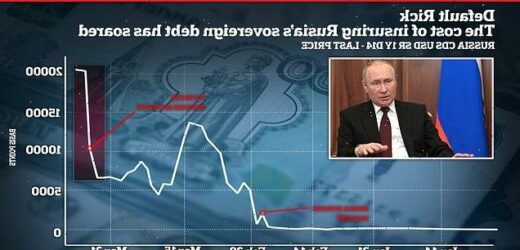

The US Treasury blocked dollar payments from Russian accounts held at American banks, forcing Moscow to make the payment in roubles. Above: The cost of the bond payments soared around the time the accounts were blocked

It would mark the first default on its international debts since the Bolshevik Revolution in 1917, with economists warning it could worsen Russia’s economic downturn.

This latest round of sanctions placed on Russia was imposed after evidence of alleged war crimes – including the killing of civilians in the town of Bucha during Russian military occupation – was revealed.

The move is designed to force Russia into choosing among three unappealing options — draining dollar reserves held in its own country, spending new revenue, or going into default, according to a Treasury Office spokesperson.

Russia’s finance ministry said on Wednesday that it tried to make a $649 million (£498 million) payment toward two bonds to an unnamed US bank, previously reported as JPMorgan Chase, but that the tightened sanctions prevented the payment from being accepted.

So instead it paid in roubles, triggering what is, in effect, Russia’s first sovereign default since the aftermath of the First World War.

‘Western countries are trying in every possible way to make Russia declare default,’ Finance Minister Anton Siluanov told state news service Tass this week. He added that Russia will use ‘other mechanisms’ to make payments.

Western sanctions have severely squeezed Russia’s economy, and S&P and other ratings agencies had already downgraded its debt to ‘junk’ status, deeming a default highly likely.

Source: Read Full Article