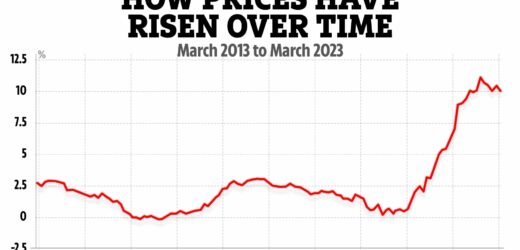

THE UK’s rate of inflation fell to 10.1% in March easing some of the pressure on people's finances.

It comes after it rose unexpectedly in February to 10.4% after falling for three months in a row.

The consumer price index (CPI) measure of inflation dropped from 10.5% in December.

Despite the fall, inflation still rose higher than experts predicted as food and drink prices continued to soar.

With soaring costs and bills, you may be concerned about how rising inflation will affect your household finances and the wider economy.

A forecast from the Office for Budget Responsibility last month states that inflation will fall to 2.9% by the end of the year.

We've broken down everything you need to know.

What is inflation?

Inflation is a measure of how much goods and services are worth in a given period.

This means how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

It is known as a "backward looking measure", which means it indicates what has happened over the past year.

That obviously means it does not predict the future.

The rate of inflation is published each month by the Office for National Statistics (ONS).

It's a non-ministerial department which reports directly to Parliament.

MOST READ IN MONEY

Huge supermarket chain launches new stores – is one coming near you?

Hundreds of thousands on Universal Credit face losing top-up worth £390

Shoppers are only just realising easy way to get free cash from Amazon

Tesco ordered to make major Clubcard change after Lidl court battle

How does inflation impact prices?

Inflation doesn't impact prices, rather it's a measure of how prices have changed over the past year.

When it goes up, it means prices on everyday items, essentials, fuel and bills are higher.

That means millions of households' budgets are squeezed.

The latest publication looked at prices in the 12 months to March 2023 compared to the previous year.

The ONS said inflation of food and non-alcoholic drinks rose by their fastest level in more than 45 years at 19.2%, with the cost of everyday essentials still ramping up.

The largest contributor to the rise in food inflation was bread and cereals, for which average prices rose by 19.4% in the year to March 2023.

What causes inflation?

The inflation rate depends on how the prices of a basket of goods and services have changed over the past year.

Inflation is measured by the ONS, which collects around 180,000 prices of about 700 goods and services used across the country.

These prices are updated every month with officials visiting the same retailers each time to ensure consistency.

The prices are then weighted with more prominence being given to products people buy more often, such as fuel rather than postage stamps, for example.

There are numerous different measures of inflation that all track slightly different baskets of goods. The main measure is known as the Consumer Prices Index (CPI), and state benefits and the state pension also rise in line with it.

There is also a Consumer Prices Index including housing costs (CPIH) measure, as well as a Retail Prices Index (RPI) measure, which is used to calculate annual rail increases and student loan interest rates among other things.

What is the UK's current inflation rate?

The CPI measure of inflation dropped to 10.1% in March 2023, the latest figures available show.

The slowdown is good news for stretched households, although inflation still remains high.

Some experts believe inflation has now peaked.

What does inflation mean for prices and the economy?

Inflation matters because it affects the value of wages, savings and more. The Bank of England has a target inflation rate of 2%.

This target is set by the government, which believes a small amount of inflation at a stable level is good for the economy.

That's because it boosts economic output by encouraging spending, which in turn means businesses can afford to generate employment opportunities.

It can also make goods more attractive to foreign buyers as it can make their currency worth more, comparatively, to another countries.

However, if inflation is too high or goes up and down a lot, it can be hard for businesses to set the right prices and for people to plan their spending.

It can also mean the cost of essential goods and services can suddenly outstrip the buying power of people's wages – this is what we are seeing in the current cost of living crisis.

At the other end of the scale, it's also a problem if inflation is too low or negative, as people may put off spending because they expect prices to fall further.

What is deflation?

Deflation – or negative inflation – is when the rate of inflation falls below zero.

This can happen when the supply of goods is higher than the overall level of demand. It can also be triggered by lower production costs, or a shortage of money in circulation.

The UK was last in deflation territory in 2015, and though some experts speculated we could see negative inflation as a result of coronavirus pressures on the economy, the latest rise in inflation makes this less likely.

This would mean lower prices for consumers, which on the surface is a good thing.

But the Bank of England points out that when prices fall, people often don't make purchases as they hope costs will fall further.

When people stop buying, less money is going into businesses and the economy, which can lead to recession, wage cuts and job losses.

How can I protect my finances against rising inflation?

The best way to beat the price hikes as inflation soars is to check your finances and see where you can cut costs.

Find a high interest savings account if possible to try and make sure your money is growing in line with inflation.

Here's a little-known website where you can get groceries cut down to as little as 9p.

Plus, this is the exact temperature your thermostat should be se to to save you money on your energy bills.

Source: Read Full Article