Bed Bath & Beyond CFO, 52, is identified as man who jumped to his death from 18th floor of NYC’s ‘Jenga’ tower – two days after firm announced plans to lay off 20% of staff and close 150 stores

- Calls regarding the jump at 56 Leonard Street near Church Street came in at around 12:30pm on Friday, according to a spokeswoman for the NYPD

- The city’s EMS officials responded to the incident and were seen carrying the man’s body off in a black body bag at the base of the famous Manhattan tower

- The man was pronounced dead before leaving the scene

- He was identified as Gustavo Arnal, Chief Financial Officer of Bed Bath & Beyond, early Sunday morning

- Bed Bath & Beyond announced just days earlier that it would have to lay off 20% of its staff and close 150 stores nationwide as high inflation and a sagging economy hammer large US companies

- Arnal took on the role of CFO in 2020, having previously worked as an executive at several major companies including Avon, Walgreens, and Procter & Gamble

The man who jumped to his death from the 18th floor of the famous ‘Jenga’ tower in lower Manhattan’s Tribeca neighborhood Friday has been identified as a Bed Bath & Beyond executive.

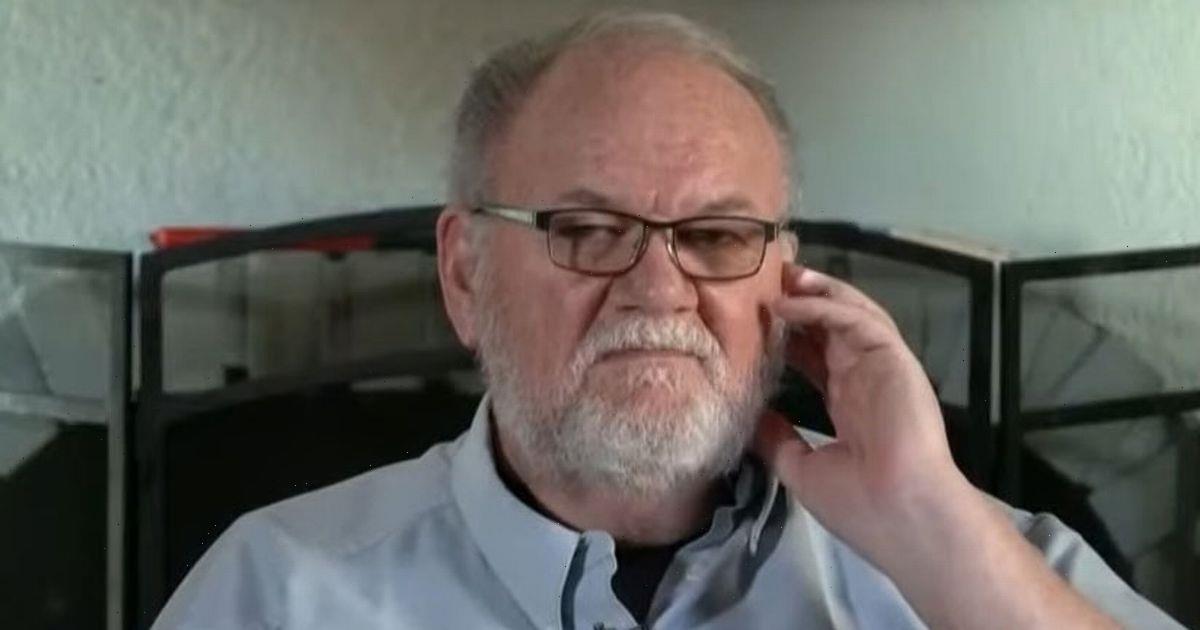

Gustavo Arnal, 52, was the Chief Financial Officer of Bed Bath & Beyond, a company that has been going through struggles of late due to high inflation and a sagging economy. The company announced plans to close 150 stores, of its roughly 900, and lay off 20 percent of staff just two days before Arnal’s death.

He reportedly sold over 42,000 shares in the company, oft-identified as a ‘meme stock’, for $1million just over two weeks ago, according to MarketBeat.com.

At the time, he still owned 267,896 shares in the company, valued at just under $6.5million.

Arnal moved to Bed Bath & Beyond in 2020 – when the company was already struggling due to the coronavirus pandemic – from London-based cosmetics giant Avon, where he was also CFO, and had spent 20 years at Proctor & Gamble.

When Arnal was brought to Bed Bath & Beyond in April 2020 a company spokesman said in a statement they were ‘bringing in world class talent to offer new perspectives, expertise and experience as we rebuild our business.’

‘Gustavo exemplifies this and his experience delivering business transformation at other leading companies, his deep knowledge of the retail and consumer goods space, as well as his energy and drive will help accelerate our transformation plans.’

Gustavo Arnal was the Chief Financial Officer of Bed Bath & Beyond, a company that has been going through struggles of late

Arnal jumped to his death from the 18th floor of a 57-story building in Manhattan’s Tribeca neighborhood Friday

The city’s EMS officials responded to the building, which was constructed in the late 2010s and has a unique ‘Jenga’-style design, at around 12:30pm

Calls regarding the jump at 56 Leonard Street near Church Street came in at around 12:30pm, according to a spokeswoman for the NYPD

Calls regarding the jump at 56 Leonard Street near Church Street came in at around 12:30pm Friday, according to a spokeswoman for the NYPD. Arnal was identified as the jumper at the 57-story building – where apartments go for up to $50million – on Friday afternoon, according to the New York Post.

Bed Bath & Beyond – once considered a so-called ‘category killer’ in home and bath goods – has seen its fortunes falter, with CEO Mark Tritton fired in June after sales plunged 25 percent in the first quarter.

The company hired Sue Gove, an independent board director, to replace him on an interim basis.

On Wednesday, Gove said the retailer was ‘continuing to see significant positive momentum’ and intended to build its ‘deep heritage as a retailer.’

‘While there is much work ahead, our road map is clear and we’re confident that the significant changes we’ve announced today will have a positive impact on our performance’ she said on a conference call.

Bed Bath & Beyond announced plans to close 150 stores of its roughly 900 and lay off 20 percent of corporate and supply chain staff

Shares of Bed Bath & Beyond dropped sharply on Wednesday following the news

The retailer also announced a plan to raise money by issuing new shares and said it had secured $500 million in new financing — but investors took a dim view of the strategic plan, and shares fell as much as 25 percent in morning trading.

Traders on the Reddit forum WallStreetBets, who have cheered the stock in recent weeks, reacted with a mixture of stoicism and despair.

‘I just wanted make money without any effort. why I have to suffer like this? why?’ wrote one user on the forum.

In Wednesday’s update, Bed Bath & Beyond also forecast a bigger-than-expected 26 percent slump in same-store sales for the second quarter and said it would retain its buybuy Baby business, which it had put up for sale.

The efforts to sell buybuy Baby had been encouraged by GameStop Chairman Ryan Cohen, the company’s biggest investor until this month when he sold out of his 9.8 percent stake, sending shares plummeting.

Once known for providing many shoppers with 20%-off coupons, Bed Bath & Beyond revamped its merchandise in recent years to focus on private-label products including its Our Table brand cookware.

The chain is now ditching that strategy, nixing three of its private label brands, and reprioritizing national brands with labels including Calphalon, Ugg, Dyson, and Cuisinart underpinning that strategy, executives said on a conference call.

Executives said Bed Bath & Beyond is cutting about 20 percent of its corporate and supply chain workforce, and eliminating its chief operating officer and chief stores officer roles. The company has about 32,000 employees overall.

Meanwhile, Snap CEO Evan Spiegel told staff in a memo on Wednesday that ad sales were not keeping up with earlier projections and announced plans to reorganize and cut roughly 20 percent of the company’s 5,600 employees.

Snap CEO Evan Spiegel told staff in a memo on Wednesday that ad sales were not keeping up with projections and announced plans cut staff by roughly 20 percent

‘Unfortunately, given our current lower rate of revenue growth, it has become clear that we must reduce our cost structure to avoid incurring significant ongoing losses,’ Spiegel wrote.

Snap will shut down ambitious projects, including mobile games and novelties like a flying drone camera, helping the company save an estimated $500 million in costs annually, the company said.

Investors approved of the move, with shares of Snap rising as much as 15 percent in morning trading.

Spiegel said Snap was restructuring its business to focus on community growth, revenue growth and augmented reality.

Anything that doesn’t contribute to those three areas ‘will be discontinued or receive substantially reduced investment,’ Spiegel said.

Arnal’s stock dump came the same day a 20-year-old college student made $110million by selling all of his Bed Bath and Beyond stock – but he did so just before the retailer’s stock price slumped 23 per cent after its second-biggest shareholder indicated plans to sell his entire holding.

An applied mathematics and economics major at the University of Southern California, Jake Freeman, 20, made a $110million profit by selling all of his Bed Bath and Beyond stock on Tuesday, nearly a month after investing in five million company shares at $5.50 a share

Jake Freeman, an applied mathematics and economics major at the University of Southern California, invested in nearly five million Bed Bath & Beyond shares at $5.50 a share in July, spending a total of $25 million with the help of a wealthy pharmaceutical investor uncle.

As a result, he became a minority shareholder by owning around six percent of America’s largest houseware goods specialty stores as it became the latest ailing retailer to see a surge in its value thanks to the ongoing ‘meme stock’ boom.

That sees amateur investors snap up stock in companies seen as past-their-best, helping to drive the share price up and making some lucky stockholders who sell at the right time millions of dollars.

Freeman, whose family resides in the New York City area, then roughly sold more than $130million worth of stock on August 16 similarly to Arnal, after the retailer’s stock price surged to $27 a share. It has since crashed back down 23 per cent to $18.55-a-share at news of investor Ryan Cohen’s plans to sell.

The building, located at 56 Leonard Street in the fashionable Tribeca district, is topped with an impossible-looking jumble of misaligned floors that make it look like a teetering Jenga tower.

The penthouse apartment in the building went for $50million.

The city’s EMS officials responded to the incident and were seen carrying the man’s body off in a black bodybag.

The city’s EMS officials responded to the incident and were seen carrying the man’s body off in a black bodybag

The man, who has yet to be identified or named, was pronounced dead before leaving the scene

A second person, also unidentified, was hospitalized with minor injuries, according to a spokesperson for the FDNY. Their condition is unknown

The man, who has yet to be identified or named, was pronounced dead before leaving the scene.

A second person, also unidentified, was hospitalized with minor injuries, according to a spokesperson for the FDNY.

A woman was seen looking distraught and crying near the building before eventually entering the ambulance.

The FDNY spokesperson could not confirm the age or gender of the person hospitalized.

The website for the structure lists such amenities as a library lounge, an indoor/outdoor theater, an estuary with a 75-foot pool, a landscaped outdoor sundeck and hot tub, a fitness center, yoga studio, steam room, sauna and a private dining room.

The website for the structure lists such amenities as a library lounge, an indoor/outdoor theater, an estuary with a 75-foot pool, a landscaped outdoor sundeck and hot tub, a fitness center, yoga studio, steam room, sauna and a private dining room

The swanky estate is the home to the mega-rich and celebrities such as Frank Ocean

The swanky estate is the home to the mega-rich and celebrities such as Frank Ocean, according to the New York Post.

Developed by Alexico Group, 56 Leonard is the first skyscraper designed by international architects Herzog & de Meuron.

It took a whopping 33 months to build – and each step was recorded by webcam company EarthCam then compiled into this incredible video.

Source: Read Full Article