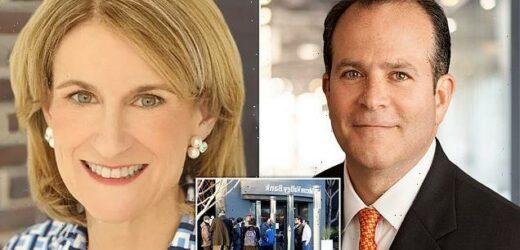

REVEALED: Former Lehman Brothers CFO was hired by Silicon Valley Bank and recently-appointed risk manager worked at Deutsche Bank when it LIED to investors and had to pay $7.2 billion

- Joseph Gentile left his position as the CFO at Lehman Brothers one year before it collapsed to join SVB as its chief administrative officer

- Recently-appointed chief risk officer Kim Olson worked at Deutsche Bank when it lied to investors about its mortgage-backed securities

- By 2021, SVB also started making risky investments before it collapsed on Friday

Two executives at Silicon Valley Bank worked at banks that contributed to the Great Recession in 2008, it has been revealed.

Joseph Gentile joined the now-failed bank in 2007 after leaving his position as the chief financial officer at Lehman Brothers’ Global Investment Bank.

His departure came just one year before Lehman Brothers, which was then the fourth-largest investment bank in the United States, collapsed — leading directly to the Great Recession.

Meanwhile, recently-appointed chief risk officer Kim Olson worked at Deutsche Bank from 2007 through 2010, when it lied to investors about its mortgage-backed securities, the collapse of which led to the housing crisis.

Deutsche Bank was later forced to pay a $7.2 billion penalty.

Joseph Gentile left his job as CFO at Lehman Brothers to take a job as the chief administrative officer at SVB in 2007, while SVB’s recently-appointed chief risk officer Kim Olson worked at Deutsche Bank when it lied to investors about its mortgage-backed securities

Silicon Valley Bank fell on Friday after a 60 percent drop in shares, which sparked a run on the bank as panicked customers rushed to withdraw cash

Silicon Valley Bank fell on Friday after a 60 percent drop in shares, which sparked a run on the bank as panicked customers rushed to withdraw cash.

It was the worst US financial institution failure since 2008, with SVB controlling $209 billion in total assets at the end of 2022. Those are now in the control of the Federal Deposit Insurance Corporation (FDIC).

But it has now been revealed that some of the very same people who contributed to the stock market crash in 2008 held senior positions at SVB.

Gentile was the chief financial officer at Lehman Brothers Global Investment Bank, the fourth-largest investment bank at the time, with $649 billion in assets and $613 billion in liabilities.

He left that position to take a job as the chief administrative officer at SVB in 2007.

Just one year later, on September 15, 2008, the bank filed for Chapter 11 bankruptcy.

The bank had branched into mortgage-backed securities and collateral debt obligations in the early 2000s, acquiring five mortgage lenders from 2003 to 2004.

It also bought BNC Mortgage and Aurora Loan Services, which specialized in loans made to borrowers without the full necessary credit.

At first the plan seemed to work, with Lehman Brothers reporting profits every year from 2005 to 2007.

But by the first quarter of 2007, defaults on subprime mortgages began to rise to a seven-year high.

The bank’s stocks started to dip, but the firm continued to report record revenues and profits for the first quarter of 2007.

By August 2007, though, the stocks were falling sharply and the company had to eliminate 1,200 mortgage-related jobs and close some of its offices.

Still, the bank continued to underwrite more mortgage-backed securities than any other firm, accumulating an $85billion portfolio, or four times its shareholders equity.

In the year that followed, Lehman Brothers’ stocks plunged even further, and the bank ultimately collapsed — leading to a run-on on other banks.

Lehman Brothers was the fourth largest bank in the US when it collapsed in 2008 as defaults on subprime mortgages began to rise. A worker is pictured here carrying a box out of the Lehman Brothers office in London in 2008

Many credit the collapse of Lehman Brothers with the beginning of the Great Recession

At around the same time, Olson was working at Deutsche Bank, which was forced to pay a $7.2 billion penalty after admitting that it lied to investors about its mortgage-backed securities, the collapse of which led to the housing market crash.

She was a senior risk manager at the firm as the bank made false and misleading representations to investors about the loans underlying billions of dollars worth of mortgage securities.

In May of 2006, before Olson started at the firm, one supervisor was quoted as warning a senior trader that a loan originator would underwrite loans to anyone with ‘half a pulse.’

That supervisor would later say that Deutsche Bank, along with several others, ‘tolerate misrepresentations’ from originators with ‘misdirected lending practices’ like a borrower’s ability to pay, accepting blacked-out pay stubs so they could claim higher incomes.

By May of 2007, the US Department of Justice said, ‘Deutsche Bank knew that there was an increasing trend of overvalued properties being sold to Deutsche Bank for securitization.

‘As one employee noted, “We are finding ourselves going back quite often, clearing large numbers of loans [with inflated appraisals] to bring down the deletion percentages.”‘

‘Deutsche Bank nonetheless purchased and securitized such loans because it received favorable prices on the fraudulent loans,’ the DOJ said.

‘Ultimately, Deutsche Bank enriched itself by paying reduced prices for risky loans while representing to investors valuation metrics based on appraisals the bank knew to be inflated.’

Then-Attorney General Loretta Lynch said in a statement at the time: ‘Deutsche Bank did not merely mislead investors: it contributed to an international financial crisis.’

Still, when Olson came on board SVB in January, CEO Greg Becker touted her experience in a statement.

‘Kim’s deep and multi-faceted financial services experience as a senior risk leader and former regulator and bank supervisor positions her perfectly to actively manage SVB’s financial and non-financial risks and to build and scale the firm’s risk management capabilities through our next phase of growth,’ he said.

Bob, who did not want to provide a last name speaks with press after exiting Silicon Valley Bank’s headquarters in Santa Clara on Monday as frantic clients tried to get their money back

Customers lined up outside the Silicon Valley Bank headquarters prior to its opening Monday. The bank counted nearly half of the country’s venture-capital backed technologies and life sciences companies as clients

By 2021, SVB also started making risky investments.

It counted nearly half of the country’s venture-capital backed technologies and life sciences companies as clients, and owned 3,234 companies — giving the bank the right to buy shares in them.

Its deposits then rose during the COVID pandemic, as more and more people wanted to protect their assets in the bank, with its deposits tripling in just a two-year span to $189billion by 2021, the Wall Street Journal reports.

Executives then decided to invest much of its excess funds in higher-yielding, long term bonds, along with $80billion in 10-year mortgage-backed securities that pay out 1.5percent rather than the short-term Treasury Department securities that pay out only 0.25percent.

That left the bank with a deposit base heavily skewed toward technology firms with huge accounts, over the $250,000 insured by the Federal Deposit Insurance Corporation.

By the end of 2022, a vast majority of the bank’s deposits, $157billion, were held in just over 37,000 accounts that were over the FDIC’s deposit-insurance gap.

It then continued business as usual, borrowing short-term from depositors and lending long-term without any interest-rates — even as Federal Reserve Chairman Jerome Powell warned that higher interest rates were coming.

As customers started to ask for their money back as the economy revamped, SVB had to sell $21million worth of its underwater long0term assets with an average interest rate around 1.8percent.

That meant that the bank lost $1.8billion on sales, leaving executives frantically trying to raise more than $2billion to fill the hole before the FDIC took control of the bank on Friday.

Source: Read Full Article