Financial watchdog urges banks NOT to close branches during lockdown because it will have ‘significant consequences’ for customers

- FCA is ‘concerned’ closures may have ‘significant consequences’ for customers

- Several banks paused branch closures at start of the pandemic before resuming

- HSBC plans to axe 82 branches after drop in footfall and surge in digital banking

A financial watchdog has today urged banks not to close their branches during the Covid lockdown because it will have ‘significant consequences’ for customers.

The Financial Conduct Authority (FCA) said banks should consider the impact of coronavirus restrictions on their ability to comply with regulatory guidance on closing branches, including consulting customers affected.

Last September’s FCA guidance on branch and cash machine closures sets out how banks should assess customer and business needs by considering what alternatives are available.

The regulator said in a statement: ‘We are concerned that these activities could have significant consequences for customers.

The FCA has urged banks not to close their branches during the Covid lockdown because it will have ‘significant consequences’ for customers (file photo of a closed Lloyds branch)

The regulator said in a statement: ‘We are concerned that these activities could have significant consequences for customers’ (file photo)

‘It may be harder than usual to reach all customers under the current restrictions and engage with them on closure proposals effectively.

‘Some customers may need to access in-branch services to help them prepare for closures but may be unable to do so. Customers may also need additional help to access online banking and making payments.

‘We want firms to review their plans against our existing guidance and ensure that they continue to comply with our Principles.’

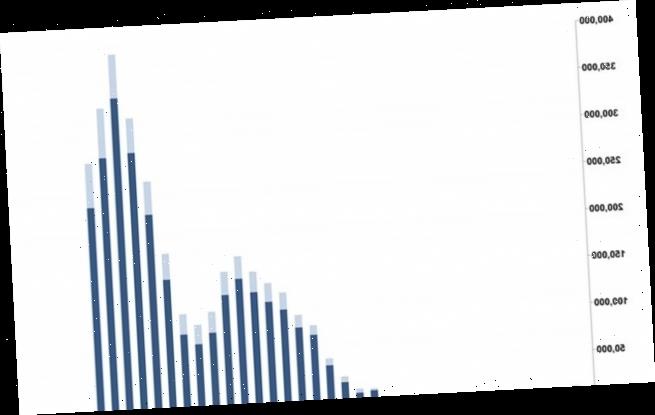

The move follows HSBC saying that it plans to axe 82 branches in Britain after a drop in footfall and a surge in digital banking, though it said the trends predated the Covid-19 pandemic.

The bank gave no immediate comment on the FCA’s statement on Thursday.

Several banks paused branch closures in the early months of the pandemic before resuming cutbacks. In the second half of last year Britain’s biggest domestic lender, Lloyds, resumed plans to cut 56 branches.

Meanwhile, Sabadell’s TSB announced it was axing 164 branches.

The FCA said: ‘We want firms to review their plans against our existing guidance and ensure that they continue to comply with our principles.

HSBC said that it plans to axe 82 branches in Britain after a drop in footfall and a surge in digital banking, though it said the trends predated the Covid-19 pandemic (file photo)

‘Where firms consider it is appropriate to continue with plans during this period, we expect them to have considered our guidance and be able to demonstrate how they’ve taken the concerns and expectations set out in this statement into account.’

It added that banks are expected to communicate with customers, especially those who are vulnerable or hard to reach, in a way that is ‘clear, fair and not misleading’ when informing of closure proposals.

The FCA then said customers should be given ‘clear information’ on how to access alternative resources, such as online banking, during lockdown.

It comes after HSBC earlier this month threatened to shut down the bank accounts of customers who refuse to wear a face mask in its UK branches.

Jackie Uhi, head of branch network HSBC UK, said that the company ‘reserves the right to withdraw’ the accounts of any customer who won’t wear a face mask.

She said: ‘Sadly, some people are failing to protect themselves, our branch colleagues and other customers by refusing to wear a face covering inside our branches or observe social distancing.

Jackie Uhi, head of branch network, HSBC UK said earlier this month that the company ‘reserves the right to withdraw’ the accounts of any customer who won’t wear a face mask

Lloyds bank stated that face coverings are essential but didn’t state whether they will be closing the accounts of those who refuse to wear masks (file photo)

‘Our colleagues deserve respect and should not have to face violent or abusive behaviour. Consider whether you need to visit the branch or could manage your banking from the safety of your home via our digital channels.

‘If you do visit us, please wear a face covering and maintain a safe distance from others. If individuals put themselves or our colleagues at risk, without a medical exemption, we reserve the right to withdraw their account.’

Other banks have come forward in the wake of HSBC’s statement to outline their stances on customers not wearing face coverings.

TSB’s director of branch banking, Carol Anderson, told The Mirror: ‘If individuals put customers or colleagues at risk, we will take appropriate action.’

Santander said that while they encourage all their customers to wear a face mask and maintain social-distancing measures, they will not be enforcing account closures.

Lloyds bank, which owns Halifax and the Bank of Scotland stated that face coverings are essential but didn’t state whether they will be closing the accounts of those who refuse to wear masks.

Nationwide and Natwest also encouraged its customers to wear face coverings.

Trade union Unite, which represents bank staff among others, is calling for the wearing of face coverings to be made mandatory in all bank branches.

Source: Read Full Article