Sales of flats HALVE as housing market is crippled by fire risk fears brought on by Grenfell cladding crisis

- Flat prices halved amid fears over cladding similar to that on Grenfell Tower

- In September last year flat transactions also fell by around 5,600, or 48 per cent

- Earlier was revealed homeowners could face £40,000 bill to replace cladding

Flat prices in the UK have halved as fears over dangerous cladding similar to that found on Grenfell Tower cripple the housing market.

Families have been left in flats they cannot sell as flat transactions worth £1.6billion were lost in September amid concerns over unsafe constructions and fire risks, figures from the Land Registry show.

In September the number of flat sales also fell by around 5,600, or 48 per cent, compared to the same month the year before, according to the Leasehold Knowledge Partnership charity.

It comes after it was revealed that thousands of homeowners could face bills of £40,000 each on average to replace dangerous cladding on their properties, similar to that found on Grenfell Tower in 2017, under new proposals by the Government.

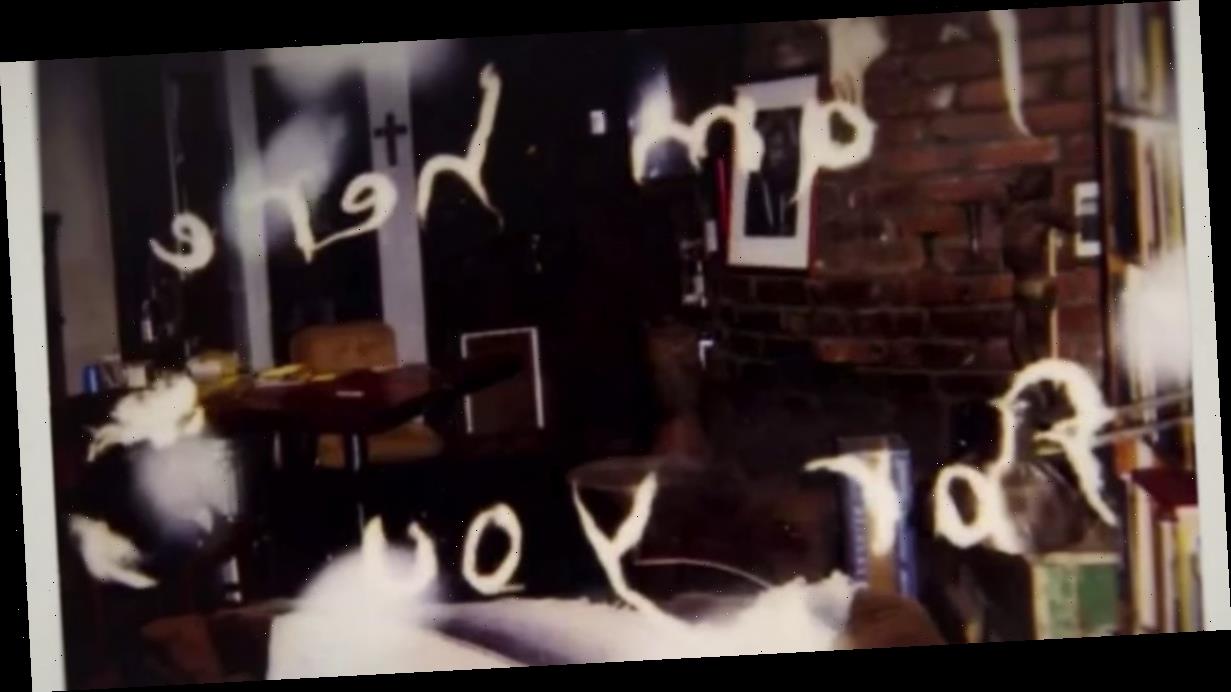

Flat prices in the UK have halved amid concerns over unsafe construction and fire risks. Pictured: Workers remove cladding from the Whitebeam Court tower block in Salford in June 2017

Across the country, around 20,000 high-rise flats still have the same cladding as Grenfell Tower and an estimated 186,000 private high-rise flats are wrapped in other types of inflammable materials, The Sunday Times revealed.

The issue has left some prospective buyers having to pull out of sales due to the drop in the housing market.

Tom Marshall, 31, and his fiancée, Jessie Andrews, 27, were due to buy a three-bedroom terrace in south London flat last year but had to pull out after their first-time buyer’s lender refused a mortgage.

The property failed an ‘external wall system’ safety check and saw the couple lose £245,000.

Mr Marshall told The Sunday Times: ‘We were buying off a lady who lost her work contract over Covid-19. She was also trying to free up capital to support her son and his family buy their first house.’

Earlier this month, it was revealed that new government proposals could force homeowners to pay up to £40,000 each on average to replace the dangerous cladding on their properties.

Ministers have set aside £1.6 billion to fund repairs, but MPs estimate the work could cost £15 billion.

Seventy-two people died as a result of the fire at Grenfell Tower when an electrical fault in a fridge-freezer sparked a catastrophic blaze in 2017

Unless the Government subsidies the scheme or developers are forced to contribute – it means the average price of a UK flat would be cut by around 20 per cent, from £209,330 to £169,330.

It would also slash 30 per cent off the average £136,261 home in the North East.

In July, the Government appointed Michael Wade, an insurance executive, to advise on how to protect leaseholders from ‘unaffordable’ costs without further burdening the taxpayer.

In December, he told the All-Party Parliamentary Group on Leasehold Reform that he was examining long-term loans but said it would be for politicians to decide who paid for the loans.

Last year, the Grenfell inquiry heard how Celotex, part of the French multinational Saint-Gobain group, ‘overengineered’ a test of Rs5000 in May 2014 to get a pass after a first test failure in January 2014.

Celotex added a 6mm fire-resisting magnesium oxide board to a cladding test rig and 8mm fibre cement panels were added over the magnesium oxide to ‘conceal’ its presence.

After a first test failure in January 2014, the second system which passed in May 2014 was used to erroneously market the combustible rigid foam boards as being safe for use on high-rise buildings such as Grenfell Tower.

Seventy-two people died as a result of the fire at the 24-storey tower when an electrical fault in a fridge-freezer sparked a catastrophic blaze which was fuelled by the building’s flammable cladding system.

Source: Read Full Article