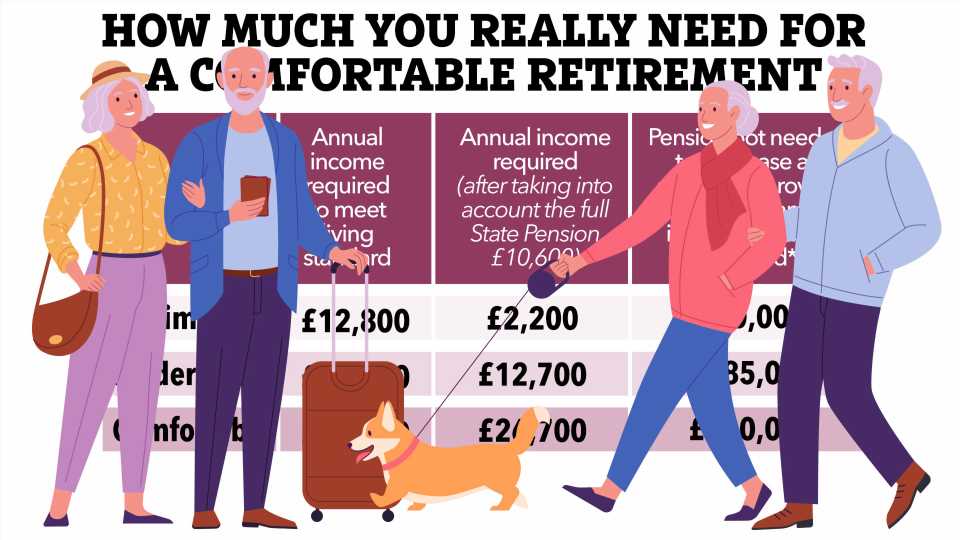

SAVERS must stash £285,000 into their pension pot over their working lives to afford a "moderate" retirement.

The Pensions and Lifetime Savings Association calculates that you'd need a retirement income of £23,300 a year to have a reasonably comfortable lifestyle, keep a car and take one foreign holiday a year.

Added to the full state pension, currently £10,600 a year, it means a single person retiring at 66 would need an extra £12,700 a year.

Insurer Standard Life looked at current annuity rates and found that to guarantee that income and ensure it rises every year to keep up with the cost of living, it would take £285,000 in savings.

For a more lavish lifestyle, to afford three holidays in Europe each year and around £145 a week to spend on groceries and meals out, you'd need a whopping £530,000 in pension savings.

Dean Butler, managing director for Retail Direct at Standard Life said: “These figures are just a guide and individual circumstances will vary but it helps to have a target in mind."

More from Money

I retired at 47 and don’t even have a pension – how you can do it too

Huge pension rule shake up for millions including age change – will you save?

Dean said you should consider a number of factors to decide what you need to save.

Life costs more in different parts of the country, for example.

And it's worth thinking about whether you'll need to pay rent or will still be paying off your mortgage after you retire.

Dean said: "The numbers we've looked at don’t account for housing costs, which a significant minority of retirees currently have.

Most read in Money

High street favourite to slash prices of kids' clothes to help hard-up families

Major change to Universal Credit rules from TODAY for thousands of parents

McDonald's is adding 6 new items in latest menu shake-up – see the full list

Primark launches click & collect at 32 shops – see full list & if one's near you

"Many more pensioners are predicted to have housing costs in the future as longer-term mortgages surge in popularity."

Even though it seems a daunting task to save so much, Dean said it's likely that your money will go further as annuity rates rise.

An annuity allows you to buy a guaranteed income for life, either a fixed amount or an amount that rises in line with inflation each year.

The amount you get depends on the type of annuity and the rates of offer.

As the Bank of England has been raising interest rates, annuity rates have also got higher.

Dean said: "Annuity rates have improved by 20% in the last year, meaning people are getting much more value for their money.

"It means pensioners can generate larger incomes from their savings.

"The value and certainty offered by a guaranteed income seems to be becoming harder to ignore.”

Standard Life also found that retirees who want a minimum living standard in retirement, which includes enough for the basics and one week’s holiday in the UK a year but no car, would need an extra £2,200 a year on top of the state pension.

To guarantee that level of income rises with inflation, the insurer said you'd need a pension pot worth £50,000 by the time you retire.

What is a comfortable retirement?

The Pensions & Lifetime Savings Association regularly looks how much you'd need to have coming in each year to afford different levels of comfort after you retire.

They count all household bills, groceries and eating out, travel costs and owning a car, holidays, TV subscriptions such as Netflix, clothes, beauty treatments and even money spent on giving birthday presents.

With the soaring cost of living, the amount of money needed to fund retirement has shot up.

In 2019 when the PLSA records began, a single retiree was spending around £620 a week to cover basic needs plus the "nice to haves".

Retirees can start to claim the state pension at 66, though if you're retiring after 2026 you'll almost definitely see that minimum age rise.

The government honoured its promise to boost the state pension in line with inflation from April.

Those claiming the full flat rate state pension now receive £203.85 a week, equal to £10,600 a year.

Not everyone qualifies for the full amount.

If you have any gaps in your career, you may have paid less national insurance and would receive a smaller state pension to reflect that.

You can top up your national insurance contributions though.

How much do you need to save?

The average pension pot for people aged 55 is currently £37,600.

Even to live at the minimum standard, you'll need to save extra into your pension – around £12,400.

Theis nearly £2,000 less than you need a year, so topping up your contributions to your workplace scheme is a good idea.

How to save for retirement

Anyone planning their retirement needs to do some careful calculations about how much they will need to afford the lifestyle they want.

A good starting point is the Government state pension age calculator, which will tell you at what age you will receive your state pension.

Pension calculators can also help you work out how much money you need to be saving to have the pension pot you want at retirement.

The earlier you start saving, the easier it is as your money has longer to grow.

Read More on The Sun

Mum shares her quick summer snack idea but parents warn it’s so dangerous

Woman who is always skinny-shamed says strangers whisper about her appearance

And you’re not on your own when it comes to saving for retirement.

Your workplace will almost certainly contribute some money to your pension pot too, and you get tax relief from the government which reduces the amount you have to pay in yourself.

Source: Read Full Article