CASHBACK credit cards reward you for your everyday spending by giving you money back on your shop.

We explain how to find the best cashback credit cards to boost your spending.

Card companies offer these types of deals because they want you to spend, so make sure you're able to meet your monthly repayments.

If you don't repay your balance in full each month, you'll start paying interest and that will wipe out most – if not all – of the cashback you've earned.

Brits who make the most of them put all their spending on them and then clear the balance when they're paid to maximise what they earn.

Here is how to make the best use out of UK cashback credit cards.

What is a cashback credit card?

A cashback credit card lets you earn money on your spending.

This could be on certain items, in certain stores, or on everything you buy.

The cashback could come as reward points or a percentage of what you have spent.

For example, if your card pays 5% cashback, you would earn £5 if you spend £100.

How do cashback credit cards work?

Like all credit cards – applying for one will leave a mark on your credit file and this could make it harder for you to be accepted for credit in the future, so it is best to do a soft search directly with a provider or through a comparison website first to check your chances of getting approved.

There are a few different types of cashback cards.

Some pay a flat rate on spending while others pay in tiers depending on how much you spend.

Others may also have special rates for spending on certain items such as fuel or in supermarkets.

Your cashback may be paid annually or monthly and could go towards paying off your credit card bill, or straight into your bank account.

You still need to payoff the full balance each month, or you may be charged interest at an annual percentage rate that can be as high as 20% or more.

There are some pitfalls to look out for though.

Some providers may charge a monthly or annual fee and there could be an introductory cashback rate that drops after a set period, after which it may not be so competitive.

Why use a cashback credit card?

A cashback credit card can be a great way to earn money back on your spending.

It can be beneficial if you are making a large and even a small purchase as it effectively gives you money off whatever you are buying.

Shoppers may want to setup a cashback credit card for their grocery shop or drivers could use one each time they topup with fuel.

Using a cashback credit card is only effective if you are disciplined at repaying your balance in full each month.

Otherwise any interest charges would outweigh the cashback rewards you have received.

It may be worth setting up a direct debit to automatically repay your cashback card each month.

How much cashback will I get?

The amount of cashback varies depending on the credit card provider.

Some may offer high introductory rates to attract you, which can drop after a year or could pay different rates depending on how much you spend.

The best cashback credit cards can pay as much as 5% but this may only be for a few months and there could be caps on how much you can receive. There may also be a minimum spend.

For example, you could earn £50 on a 5% cashback card if you spent £1,000.

However, some cards may have a fee, which will reduce your cashback.

Some credit card providers could give you reward points instead of cash that can be redeemed to buy days out, flights, holidays or just a cup of coffee.

Are there any fees?

Some cashback credit cards may charge a monthly or annual fee.

Often those paying the highest rate of cashback also have a charge for users.

This can eat into your cashback returns so make sure you are actually going to use a card before you sign up.

For example, if you had a card paying 5% cashback but a £25 annual fee, you need to spend more than £500 in a year to earn more than the cost of the card.

There will also be fees and interest charged for withdrawals on a cashback credit card so it is best to avoid doing this.

Remember interest will also be charged if you don't clear the balance each month.

Are cashback rewards taxable?

Cashback is different to savings interest.

You may be receiving a regular rate on your credit card spending but HMRC treats cashback as a discount rather than something that is taxable like a savings account.

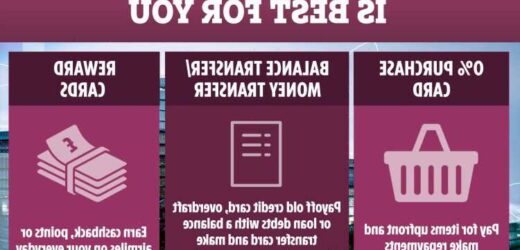

Should I get a rewards card or a cashback credit card?

The best cashback credit card pays you a decent amount of interest based on your spending.

You receive this in cash that is added to your credit card balance or it can be sent to your bank account.

In contrast, a rewards card gives you points that can be redeemed against further spending.

For example, you could get a rewards card that lets you earn air miles or points on your fuel or shopping such as from Clubcard or Nectar.

It is easy to understand how much you have with a cashback credit card as you get sent a monetary amount.

A rewards card is different as you earn points and need a certain amount to purchase items.

Your provider will be able to tell you how many points you need if you want to use your rewards for something like flight tickets or experiences, and may even give you bonus points.

It may be worth using a rewards card if you are a frequent flyer or want to earn points towards cheaper fuel or groceries.

However, you need to work out how much you are spending initially to get the points and how this compares with buying the same thing separately.

What are some alternatives to cashback credit cards?

A cashback credit card is only effective if you are spending the minimum required and if you clear your balance each month.

There are other forms of credit cards that can help with your shopping.

A purchase credit card offers interest-free spending.

This means you can make a purchase and focus on repaying the balance with 0% interest as long as you clear the bill.

Alternatively, it may be worth considering cashback websites that give you money back on your credit or debit card spending – but this is paid by retailers rather than from a bank or building society.

Source: Read Full Article