The number of people affected by scamming has surged during lockdown. Here, one woman shares her experience of being caught out by the so-called ‘Royal Mail scam’ – and how it felt to lose everything.

The coronavirus pandemic has forced us all to rely on technology more than ever before. Whether you’ve had to work from home for the first time, order groceries online or stay in touch with friends via Zoom, the ongoing lockdown restrictions have transformed our phones, tablets and laptops into essential tools for getting through the day.

While technology has obviously played a positive role in keeping us engaged and connected during this uncertain time, it’s definitely had its downsides – one of which has been a rise in the number of people affected by online scamming.

According to research conducted by Ocean Finance at the end of last year, there’s been a 12% rise in the instances of fraud reported in the last year alone – with a whopping 1,467,962 cases reported in the period 2018-2020.

Although our newfound reliance on technology is not the only factor at play here – there’s been a huge surge in coronavirus-related scams taking advantage of the current climate, for example – it’s definitely taken its toll, with many people who never imagined they’d be caught out by a scam being affected.

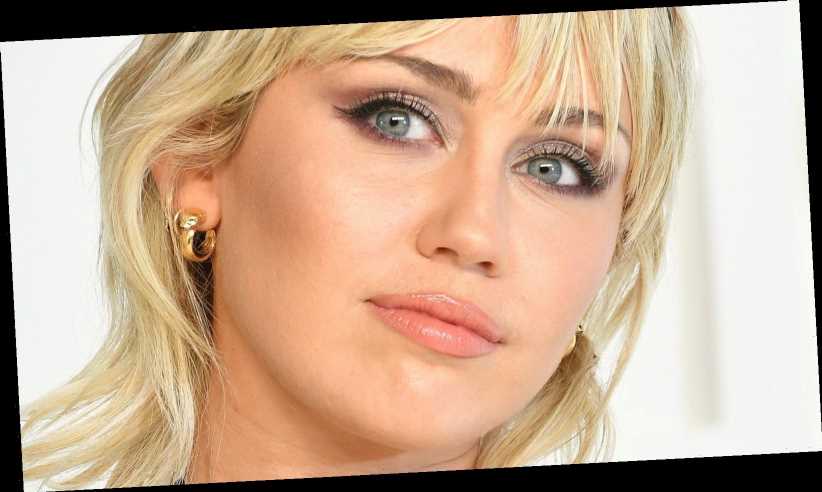

Emmeline Hartley, 28, is one of those people. Despite believing she’d done her due diligence to avoid being caught, she lost hundreds of pounds after falling victim to a scam that started with a text claiming she had a shipping fee to pay on a Royal Mail parcel.

After filling in her details on what she didn’t know was a fake Royal Mail website, she was met by a call from someone claiming to be from her bank, informing her that she had actually fallen victim to a scam, and that someone now had access to her accounts. To protect her money, the caller instructed her to transfer her money to a “safe” new account.

The only problem? The person on the phone wasn’t from Barclays, just as that original text hadn’t been from the Royal Mail. And despite doing further security checks before transferring her money (even checking the number the person was calling from was the official Barclays fraud line, which it was), the scammer passed all of them, and Hartley was unable to realise the call wasn’t legitimate until it was too late.

“It all sounds so stupid now, but, like a fool, I trusted this man,” she wrote in a statement posted to Twitter. “This man knew it was my birthday, he knew I have been excluded from government support throughout the pandemic due to being newly self-employed, he knew I am a student and he knew I currently have no meaningful income.

“He knew all those things because of how profusely I’d thanked him for protecting my money and went on to explain how devastating it’d have been if the transactions were successful. Yet he had no shame in watching me clear out all my accounts to £0.”

Although Hartley has since been able to get in contact with Barclays and has been told that she will receive a full reimbursement, she says the whole experience has been “really scary,” and has left her feeling incredibly overwhelmed and anxious.

“Before the call ended, I’d clocked what was happening and I started hyperventilating and crying, and then as soon as the scammer hung up, I just screamed,” she tells Stylist. “I sobbed and sobbed and sobbed for nearly three hours while I was on hold to Barclays trying to get it all sorted out, and I was just exhausted and drained emotionally.”

Hartley adds: “The reason I reached breaking point after that phone call, is because it’s come after a series of financial crises for me… that was kind of the final straw – I had £500 in my account that was for me and was supposed to last several weeks. And to suddenly lose that and not have anything after so long spent in crisis? I just broke.”

In a statement, Barclays said they were continuing to work hard to try and stop scammers like the ones who targeted Hartley – especially when it comes to thieves imitating their official phone numbers to dupe people into believing the scam is legitimate.

“We are committed to tackling scams and work closely with the telecommunications industry to support them on preventative measures,” a spokesperson for the bank said. “We continue to be part of an ongoing industry-wide trial to combat ‘smishing’ activity. The SMS SenderID Protection Registry allows businesses using SMS to register and protect the message headers used when sending text messages to their customers.

“In addition, we are part of the ‘Do not originate’ scheme, created in partnership with the telecommunications industry, UK Finance and Ofcom, to prevent our most common inbound helpline phone numbers from being used in a scam.”

If Hartley’s experience and the rise in the number of instances of fraud being reported can teach us anything, it’s that anyone can be affected by scamming – even those who consider themselves to be pretty savvy and switched on when it comes to technology.

This was the case even before the pandemic – research published by Lloyds Bank in 2019 found that millennials were falling victim to scams involving handing money to fraudsters more than any other age group – but with so many of us now living the majority of our lives online, we’re even more at risk.

So, what can you do to try and protect yourself from these types of scams? According to Raj Samani, chief scientist and fellow at McAfee security, one of the best things we can all do to protect ourselves is go straight to the source of any messages we receive.

“Because text messages are checked regularly as part of our daily routines, people often forget to double-check if the sender or links are legitimate before clicking on any embedded links, especially if the text is sent by a known legitimate company,” Samani explains.

“If you receive a text message you weren’t expecting, it’s best to check out the company website or your company account directly, rather than clicking on any direct links you receive within the message.”

In a statement posted on Twitter, Royal Mail confirmed that they wouldn’t send a text to notify if a fee was due – instead, they’d leave a grey card.

“We’ll only send SMS notifications where the sender has requested this and uses a product that offers this service,” they added.

For more advice on how to spot a fake notification and for examples of current Royal Mail-related scams going around, you can visit the Royal Mail’s Scam Protection and advice page.

For extra information and advice on how to avoid being scammed, you can also visit the Take Five To Stop Fraud website.

Images: Getty/Emmeline Hartley

Source: Read Full Article