MILLIONS of families are being squeezed by soaring heating costs and food prices, but a money expert has revealed how he slashed his spending by more than £1,000 a year by making tiny bill changes.

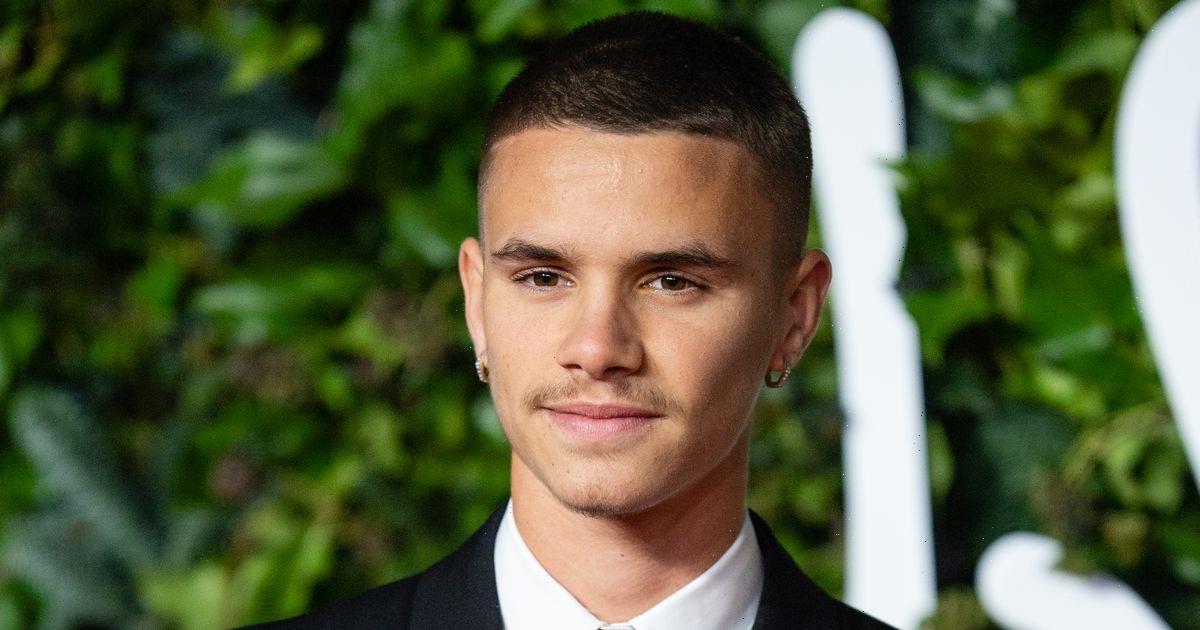

Consumer expert Martyn James, from Resolver, has more than a decade’s experience helping people to cut costs and claim back cash when companies treat them badly.

Consumer expert Martyn James, from Resolver, has more than a decade’s experience helping people to cut costs and claim back cash when companies treat them badly.

He’s just one of the experts on our expanded Squeeze Team which is here to help you save money.

Whether you’re worried about paying your bills, need to clear debts or don’t know what to do with your pension, get in touch TODAY on 0800 028 1978 between 8am and 8pm.

You can also email [email protected] anytime.

Our Squeeze Team has already helped tackle Alex Larke's problems as he faces a terrifying choice between eating and heating.

The 43-year-old sang for the UK in Eurovision, but now owes £40,000 and struggles to heat his home.

Most read in Money

OUT OF CREDIT Amazon U-turn as it scraps Visa credit card ban two days before rules kick in

HSBC app down leaving hundreds of customers unable to access accounts

I'm so addicted to the lottery I've just won my 4TH jackpot – a total of $4.6m

Why you should NEVER miss a council tax payment as millions fall behind on bills

Martyn said that anyone who is feeling under pressure like Alex should look into how much they could save by going through their monthly payments and cutting unnecessary subscriptions.

He said: “I managed to cut my costs by a whopping £1,000 a year after going through all my monthly payments and getting rid of subscriptions that I no longer use.

“Millions of us are letting money drain out of our accounts each month for services we don’t really need.”

“It takes just an hour to trawl through your accounts”

Theatre membership: £108 per year

Three video streaming services: £192 per year

Automatic repeat orders items bought via Amazon: £187 per year

Gym membership: £420 per year

Billing error for anti-virus software: £90

Total = £1,006

Martyn said: “It’ll take you just one hour to go through your bank and credit card statements with a fine-toothed comb and you could save a fortune like me.

“If you didn’t give the company permission to charge you in the first place you can even claim back the cash that they’ve taken from you.

And, it’s not just standing orders and direct debits that you need to look out for, he warned.

“Many companies charge you using what’s called a ‘continuous payment authority’.

“These don’t show up on your standing orders or direct debits lists but can be used in just the same way to debit you on a regular basis monthly or annually.”

Instead you’ll need to scan through all the transactions on your bank account to spot them.

It’s also a good opportunity to check for billing errors and fraud.

Martyn said: “These recurring payments can also be loitering on your credit card, on payment services like PayPal and even on your mobile phone bill.”

Here are some of the payments to look out for:

Cloud storage

SAVE: Around £120 a year

It’s easy to end up paying over the odds to store photos and videos in the cloud.

Martyn said: “When you buy a mobile, tablet or laptop you might be prompted to sign up for storage services like iCloud or when you log into your emails you might be offered extra storage space at a cost.

“Firstly, make sure that you’re not holding onto any large files such as videos that you don’t need.

“Also, check you are not paying for multiple different storage services when you could make do with one.”

You might be able to save money by buying an external hard drive and storing all your treasured photos and memories there rather than paying for cloud storage every month.

Streaming

SAVE: Up to £240 a year if you cancel two services

Could you cut back on the number of TV and music streaming services you’ve signed up for?

You might be paying for more than you need.

See whether you can save money with a TV and broadband bundle rather than paying for lots of subscriptions separately.

Check on a comparison website like uSwitch.com to see if you can find a cheaper deal.

If you’re willing to put up with adverts then you can use services like Spotify and YouTube for free.

Mobile and gadget insurance

SAVE: Up to £240 per year

Many of us are doubling up when it comes to phone and gadget insurance.

Martyn said: “When you upgrade your mobile, companies will often try and foist an insurance policy on you.

“You might just assume that they’ll cancel the old one but that’s not always the case.

“I recently helped a man claim back over £500 for four policies he had lurking on his account.”

If you have home contents insurance, check whether your mobile and other gadgets are covered under this.

If they’re not already covered, adding phones and other valuables to your home insurance can be cheaper than getting standalone cover.

Some paid-for bank accounts come with free mobile phone insurance so check if you have one of those.

Travel and breakdown cover

SAVE: Up to £120 a year

As well as offering gadget insurance, some of the bank accounts that charge you a monthly fee also provide breakdown and home emergency cover.

Check whether you have one of these accounts before you pay for AA or RAC membership separately.

Gym memberships

SAVE: Up to £420

Depending on where you go, gym memberships can cost up to £300 a year.

There are so many free work-outs you can follow on YouTube or download the free Couch to 5k beginner’s running app from the NHS.

Dating sites

SAVE: Up to £480 a year

The quest for love can be an expensive game.

Save by sticking to free services rather than upgrading to expensive “premium” options which can cost up to £40 a month.

Martyn said: “The free complaints service, Resolver, dealt with 4,000 cases relating to dating websites and premium services last year and the costs can be jaw-dropping.”

Subscription traps

SAVE: Up to £480 a year

How many times have you been offered a free trial and told yourself that you’ll cancel before you have to start paying?

Many companies use this trick to get your card details knowing that you’ll probably forget to unsubscribe when the trial ends.

Some of these are legitimate companies and you should contact them at once to stop the payments.

They might even be willing to refund you if you haven’t used the service during the months that you paid for.

Other times these subscription traps are outright scams.

You might have signed up for a free beauty product or slimming bills without realising that the company would start taking regular payments from your card.

Companies may be based abroad and impossible to contact.

If you didn’t agree to ongoing payments, contact your bank or credit company to block any more from going out and ask them to refund you for fraud on your account.

To grab some other advice on things like transport costs or water bills, The Sun has put together more advice from The Squeeze Team, and you can read about them here.

More specifically, if you're a Netflix fan who just can't ditch the flics, you can learn more about making the subscription cheaper here.

Though sometimes cutting back on costs isn't quite enough to make your money stretch further. If you need cash help, you may be able to get support from your local council as part of The Household Support Fund.

We pay for your stories!

Do you have a story for The Sun Online Money team?

Email us at [email protected]

Source: Read Full Article