MARTIN Lewis has explained how to claim back thousands of pounds from your bank in two ways.

The cash is available to customers who've either been mis-sold packaged accounts or where bank charges put you in financial difficulty.

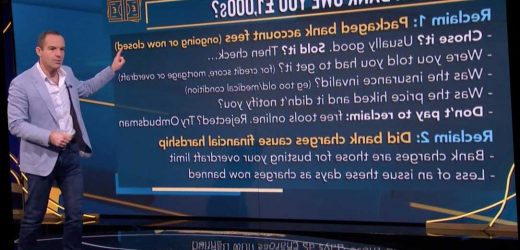

Speaking on The Martin Lewis Money Show last night, Martin said: "Does your bank owe you thousands of pounds? Two reclaims here.

"The first is for packaged bank accounts. They are those where you pay a £10-£15 monthly fee in return for insurance."

If you chose it and it's right for you, it's usually not a problem, Martin explained.

However, "if you were told you had to get it, you were probably mis-sold", he added.

How do I know if I’ve been mis-sold a package bank account?

IF any of the below points apply to you, you should be able to make a claim.

- You were wrongly told that you had to get it if you wanted to get something else, such as a mortgage or an overdraft.

- You couldn't actually claim on the insurance because of a pre-existing medical condition or you were too old.

- You were told it was a privilege to get the account but it wasn't explained properly to you; the salesman wouldn't say no for an answer or you weren't told the full cost.

- The price was hiked but the bank didn't tell you.

- The fee was added without you knowing, for example, it was "upgraded" without your permission.

- You were forced to keep the account, even though you tried to close it.

- You weren't told that you needed to register your car or gadget before claiming.

- You were told the account would improve your credit score.

The same applies if the insurance was invalid, for example if you were too old to make a claim on the policy, or if the price was hiked and you weren't told about it.

Another way to reclaim cash from your bank is if your bank's charges caused you financial hardship.

Martin said: "This is much less big than it used to be, but you can still put in a claim."

Below we explain how to claim for both issues.

How to reclaim for mis-sold packaged bank accounts

In 2019, the worst packaged bank accounts for offering poor savings and limited insurance cover were revealed by consumer champion Which?.

If you think you've been mis-sold a packaged bank account, you'll need to get in touch with your bank to make a claim.

There are free tools available online, such as this one by MoneySavingExpert, so make sure you don't pay a claims firm to help you.

If the bank rejects your claim, you can take your complaint to the Financial Ombudsman for free.

But it won't look at your complaint until you've contacted your bank first and given it eight weeks to respond.

If you were mis-sold, you should get the monthly fees back plus interest.

One viewer told The Martin Lewis Money Show she managed to get a £1,400 payout from NatWest after paying for a packaged account for 10 years.

If you've got a useless packaged account, you can cancel it first to stop paying the monthly fees and then reclaim the cash later.

How to reclaim bank charges

If you've been put in financial hardship due to bank charges for going over your overdraft limit, it's also worth making a claim.

Lenders previously charged between £2 to £30 a month for an arranged overdraft.

While unarranged fees could be much higher – up to £6 a day or £80 a month, which could add up to hundreds of pounds.

These rip-off charges were banned in April 2020, but you can make a historic claim.

While there are no rules that guarantee a payout, watchdog guidelines state that banks have a responsibility to treat you fairly.

How one man won back £2,500 from his bank

GETTING into debt can leave you in a really sticky spot, as lorry driver Leon Ray found out.

After taking out a £3,100 overdraft with the Bank of Scotland he was left struggling to repay overdraft charges of up to almost £1,682 a year.

Banks are meant to look out for vulnerable customers.

But the 29-year-old was able to easily increase his hefty overdraft at the same time as spending thousands on online gambling sites in the midst of a gambling addiction

After The Sun got in touch, the bank offered Leon a £2,516 refund in overdraft fees as a gesture of goodwill.

Bank of Scotland told The Sun at the time he increased the overdraft he met all of their lending criteria, but they recognised some people’s circumstances did change and wanted to help.

First of all, you'll need to contact the bank and prove that you were in financial hardship which the fees contributed to or made worse.

For example, if you couldn't pay for necessities such as your mortgage or food bill, or pay your debts, or you were continually living off credit then you may be entitled to your money back.

You should work out how much you spent in overdraft charges so you know how much you should ask for.

If you don't know how much you've paid you can check your online banking or you can ask the bank for your old statements by calling or writing a letter.

Once you have all of this information, you'll need to write to the bank to ask for your money back.

MoneySavingExpert and Money.co.uk both have a free template you can use.

The bank may offer you a full or partial refund of around six months' worth of charges as a goodwill gesture.

If you don't feel that that's enough, contact the bank to ask for what you think you're owed but remember that it's a negotiation and it doesn't have to budge.

Martin Lewis has also urged Brits to apply for £5,000 Green Homes Grant vouchers before the money runs out.

He's also explained how to get free groceries at Asda, Sainsbury's and Co-opincluding tea bags, milk and biscuits.

Plus, he's warned 1.8million workers risk 2.6% interest charges for missing a HMRC tax deadline.

Source: Read Full Article