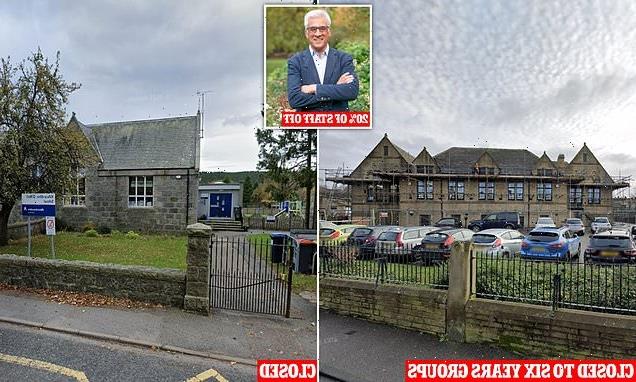

MARTIN Lewis has warned millions of households they face extra costs as energy bills could rise by £600 within months.

The consumer expert has explained how energy customers should prepare for the increase.

Experts predict energy bills will rise by 51% when the price cap is reviewed by the energy regulator Ofgem, with an increase applied from April.

Speaking on ITV's Good Morning Britain, Martin explained that as the date approaches, they have a "good idea" how much the cap will increase based on how wholesale prices have gone up already.

The price cap is currently £1,277 for those not on prepayment meters. With the expected increase of 51%, it means the typical bill could shoot up to £1,925 a year from April 1.

The price cap, which means you can't be charged more than a certain rate for the energy you use, is now cheaper than fixed deals being offered by energy firms.

Fixed tariffs used to be cheaper but that's no longer the case, and more than half of households are now on a default tariff that is price capped.

Martin said: "In the past, I used to warn against being on the price cap because it was more expensive.

Most read in Money

SHABBY CHIC Four-bed Victorian house would make idyllic family home – but there's a catch

Cadbury has hidden chocolate eggs across the UK – you could win up to £10,000

Urgent Costa Coffee warning as fan favourites come with health risk

Incredible 5-bed townhouse boasts sea views – and TWO hidden secrets

"But right now the price cap, the default tariff that most people are on… is far far cheaper than most fixed deals and there are no meaningfully cheaper deals right now."

He said the vast majority should "do nothing" and stay on their standard tariff (which is limited by the price cap) and plan ahead for the increase in bills.

Energy customers are on a standard tariff if they've never switched or if you had a cheap fix and the deal ended and you didn't choose a new one, he explained in his Money Saving Expert newsletter.

Anyone whose energy supplier went bust and has been moved to a new company is also on a default tariff.

But a small number of customers who remain on fixed deals may be able to save cash.

Martin said that if they can get a new offer that is no more than 40% more expensive than the current price-capped tariff they could save money.

"It may well be worth it but there aren't many of these [deals] available," he said.

He also urged hard-up Brits to check whether they can claim benefits such as the Warm Home Discount or if they can get an energy grant.

The MoneySavingExpert founder has called for Government intervention to prevent an energy bill crisis before April, calling it a "nightmare that'll throw millions into fuel poverty".

Yesterday the Prime Minister promised he would “do what we can to help” as the cost of living crisis sees bills soar.

But Boris Johnson poured cold water on scrapping VAT on bills — calling it a “blunt instrument” which will not focus on the most needy.

He had promised to ditch the charge in the Brexit referendum as a key bonus of leaving the EU.

The energy price cap rise in April will come at the same time as a hike in National Insurance and an increase to council tax bills hit people's pockets too.

Energy bill help – what you can get

Anyone struggling with their energy bills could get help from a number of schemes from the government, energy firms and local councils.

Warm home discount scheme

The warm home discount is a one-off payment of £140 which is designed to help with the cost of your electricity bill through winter.

The money isn't paid to everyone automatically, you need to apply for it from your energy firm if you're on a low income.

The money is taken off your energy bill between September and March.

If you get the guarantee credit element of pension credit and are named on the bill you should automatically qualify for this benefit.

But if you're on a low income or struggling with bills then you'll need to apply for the money off from your supplier if they offer the scheme.

Each provider has different criteria, so you should check carefully to see if it applies to you.

Anyone who has moved to a new supplier because theirs collapsed will need to make a new application for the cash.

You'll need to apply sooner rather than later as there's a limited pot of cash and once that's gone applications close.

Cold weather payments

If temperatures plummet below zero that could trigger a payment of £25 automatically.

Cold weather payments are made if it hits freezing between November 1 and March 31, to help you pay for the increased energy costs.

The temperature will have to stay that low for seven consecutive days before the cash is handed out.

You can check if the payment applies to you using the government's postcode checker any time between now and the spring.

You don't need to apply for the extra payment – it's paid automatically into your bank or building society account within 14 days of the cold spell ending.

You must already be getting certain benefits to qualify, including pension credit, income support, jobseeker's allowance, income-related employment and support allowance, and Universal Credit.

Grants and help from energy companies

If you’re in debt to your energy supplier, you might be able to get a grant from the British Gas Energy Trust to help pay it off.

This scheme is available to anyone – you don't have to be a customer – and you can find out more and apply here.

Several companies also offer a grant scheme for their customers including:

- Scottish Power Hardship Fund

- Ovo Debt and energy assistance

- E.on Energy Fund

- EDF Energy Customer Support Fund

The conditions of each scheme vary, so contact your energy provider to find out more.

If you need help, make sure you speak to your provider to see what they can do.

If you have a prepayment meter and you can’t top up – either because you are isolating or because you can’t afford to – your energy provider must help you.

For instance, it can let someone else top up for you, send you a pre-loaded top-up card, or increase your emergency credit limit.

You might be able to get help from your local authority through "housing renewal insurance" or through local welfare provision schemes.

Some might be able to help with heating costs or emergencies, such as a boiler breakdown.

Check to see what support your local authority provides and check whether it is a loan or a grant before you accept anything.

If there is a Home Improvement Agency, it may be able to apply to its charitable arm, the Foundations Independent Living Trust, for grants to help make your home warmer.

Household Support Fund

The government has given more money to local authorities to help those struggling pay for bills and food because of the coronavirus pandemic.

Under the Household Support Fund, councils can use cash in a number of ways to help people cover the cost of heating their home.

In some cases councils are offering as much as £60 in a payment to help cover gas and food too.

You can ask your local authority directly what help is available as it depends where you live.

We pay for your stories!

Do you have a story for The Sun Money team?

Email us at [email protected]

Source: Read Full Article