More than 9000 Victorian businesses will be slugged with a new tax to help the state government deliver a multi-billion boost to mental health that Treasurer Tim Pallas described as generational reform.

The high-taxing budget will see businesses with payrolls of more than $10 million hit with a 0.5 per cent levy from 2022, which is expected to raise $843 million a year over the next four years. Larger businesses with a payroll bill higher than $100 million will pay an additional 0.5 per cent on the share of wages paid in Victoria.

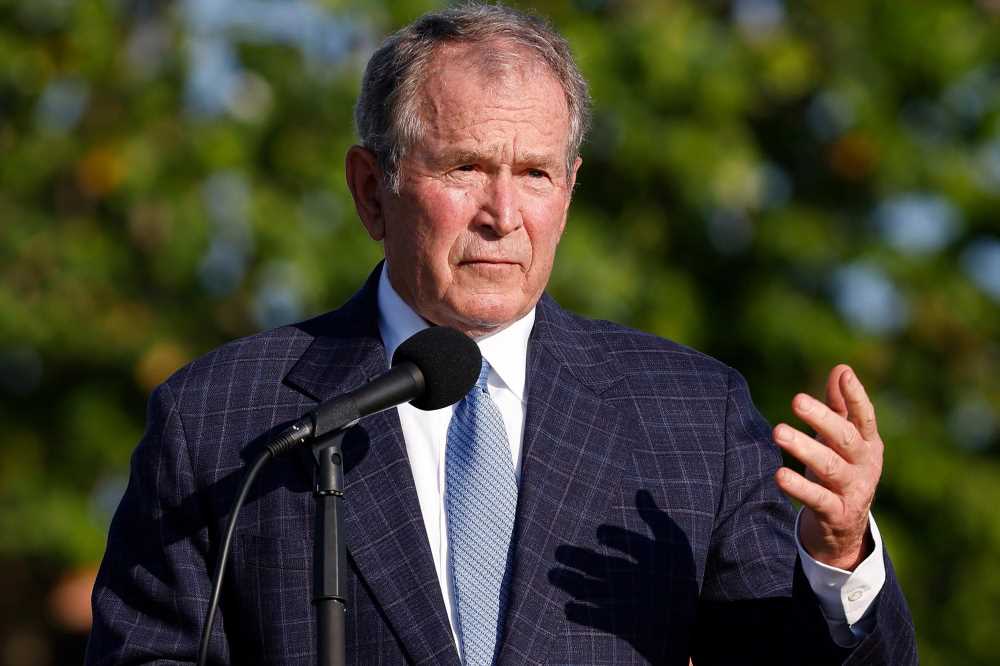

Treasurer Tim PallasCredit:The Age

The government justified its hit to businesses claiming big businesses had “continued to profit through the pandemic, pocketing taxpayer subsidies along the way”

Treasurer Tim Pallas described the new levy as “appropriate” and “fair”.

“We’re asking those businesses to help deliver a generational reform after one of the most mentally taxing years of our lives.”

In total, the state government’s tax revenue increased by more than 13 per cent next financial year based fuelled by stamp duty increases for properties that sell for more than $2 million as well as new taxes on developers and employers.

Victoria’s debt is still on track to skyrocket to $102 billion next financial year, rising to $156.3 billion over the next four years. A $17.4 billion deficit was recorded for the current financial year, which expected to shrink each year over the next four years.

Treasury has forecast Victoria’s economy will grow by 6.5 per cent in 2021-22, higher than the projected 4.25 per cent growth for Victoria and above national growth. But the budget papers show public demand and government spending are the only positive contributors to Victoria’s growth.

The state government is banking on strong businesses confidence, interest rates remaining low and the vaccine being rolled out quickly.

With both a Victorian and Federal Election due by the end of next year, Mr Pallas denied the state’s government’s high-taxing agenda would hand the Coalition a political weapon ahead of polling day.

“We don’t really need lectures from the federal government about how to run economies.”

“The choices that we make reflect our values as a government. Our values are that we need to grow jobs and new need to care for those in the community who need support.”

Mr Pallas said Victoria’s growth was propping up the nation with state demand more than double the rate of GDP growth.

Before the pandemic, net overseas migration was the largest driver of population growth for more than a decade. Thursday’s budget papers show the state’s population growth will be sluggish over the four years of forward estimates, growing by just 0.3 per cent in 2021-22 and rising to 1.7 per cent growth in 2023-24.

That rate remains below the annual growth rate of 2.3 per cent over the five years before the pandemic.

The Government is projecting an extra 400,000 Victorians will be back to work by 2025 but employment growth is expected to be sluggish in the coming years, rising by 2.5 per cent next financial year.

Weak international economic conditions have impacted the state’s exports meaning net trade will have a negative impact on growth in 2020-21 and 2021-22.

Unveiling his seventh budget on Tuesday treasurer Tim Pallas said it was “not the time to fixate on a surplus”.

“With interest rates at record lows we could borrow to protect jobs and drive a stronger recovery,” he said.

The government will spend $86.2 billion next financial year before dropping by 2.9 per cent in 2022-23.

Mr Pallas said the government’s wages bill – which is forecast to grow by about 10 per cent this year and will rise by a billion dollars for each of the next three years – was “unsustainable”.

Public sector pay has risen from $19.9 billion when the Andrews government came to power to almost $32 billion, prompting the government to cap wages ad reduce departmental spending from next year.

After taking over the leadership of the federal Labor Party, Opposition Leader Anthony Albanese has dropped a number of Shorten-era policies including changes to capital gains tax, negative gearing and franking credits following scare campaigns which claimed Labor was going after aspirational Australians and the top-end-of-town to bank it’s spending agenda.

Start your day informed

Our Morning Edition newsletter is a curated guide to the most important and interesting stories, analysis and insights. Get it delivered to your inbox.

Most Viewed in Politics

From our partners

Source: Read Full Article