Warner Bros. Discovery trimmed its losses in its second quarter but saw revenue fall in key areas such as advertising and content production as the company, built from a merger of WarnerMedia and Discovery Communications, continues to navigate shifting terrain in the media sector.

The owner of the Warner Bros. studio, CNN and the Discovery Channel posted a net loss of $1.24 billion, or 51 cents a share, compared with a net loss of $3.42 billion, or $1.50 a share, in the year-earlier period. The current quarter’s net-loss includes $1.66 billion in pre-tax amortization charges

Total revenue was off 4% on a pro-forma basis. Advertising revenue fell to $2.45 billion from $2.62 billion in the year-earlier quarter due to shrinking linear TV audiences and a choppy U.S. ad market. Revenue from its studios declined to $2.58 billion from nearly $3 billion due to fewer series sold and comparisons with performance last year.

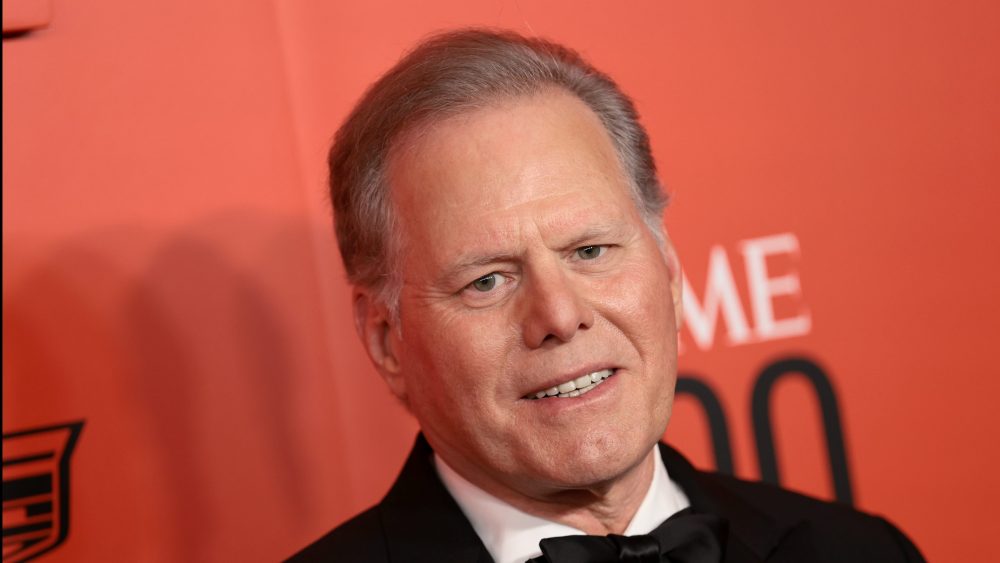

In a statement, Warner Bros. Discovery CEO David Zaslav said the company was focused on reducing the massive debt it had accrued to put the merger into place and in generating free cash flow from its operations, which increased during the period. Such activity, he said, “positions us well to lean into growth opportunities that will ultimately drive shareholder value.”

Indeed, overall free cash flow totaled $1.72 billion, compared with $789 million in the year-earlier period, surpassing Wall Street estimates. “Revenues remain somewhat choppy but WBD is managing to do what it can,” said Wells Fargo analyst Steven Cahall in a Thursday research note.

More to come…

Read More About:

Source: Read Full Article