Peloton stocks make a partial recovery after CEO DENIED claim in leaked memo that home fitness company was halting production of bikes and treadmills

- Share prices for Peloton rose nearly 16 percent to $28.06 on Friday after plummeting 27 percent to $24.22 on Thursday, a two-year low

- Peloton closed at $27.06 on Friday, ending the day with a nearly 12 percent increase from Thursday’s record low

- The huge dip came after a leaked presentation revealed the company has seen a ‘significant reduction’ in demand for the products

- The company planned to pause bike production in February and March and not manufacture the Tread treadmill machine for six weeks, beginning in February

- ‘Rumors that we are halting all production of bikes and Treads are false,’ co-founder John Foley said in response to the leaked memo

Peloton stocks made a partial recovery on Friday, a day after CEO John Foley claimed in a leaked memo that the home fitness company was halting production of bikes and treadmills.

Share prices for Peloton rose nearly 16 percent to $28.06 on Friday afternoon, after plummeting 27 percent to $24.22 on Thursday, a two-year low.

Peloton closed at $27.06 on Friday, ending the day with a nearly 12 percent increase from Thursday’s record low.

The huge dip came after a leaked presentation revealed that the company has seen a ‘significant reduction’ in demand for its products.

The report, first seen by CNBC, said the company planned to temporarily pause bike production in February and March and will not manufacture the Tread treadmill machine for six weeks, beginning in February.

It was reported that the company is not looking to produce any Tread+ machines in fiscal year 2022 and has thousands of cycles and treadmills lying in warehouses or on cargo ships.

Share prices for Peloton rose nearly 16% to $28.06 on Friday afternoon after plummeting 27 percent to $24.22 on Thursday, a two-year low

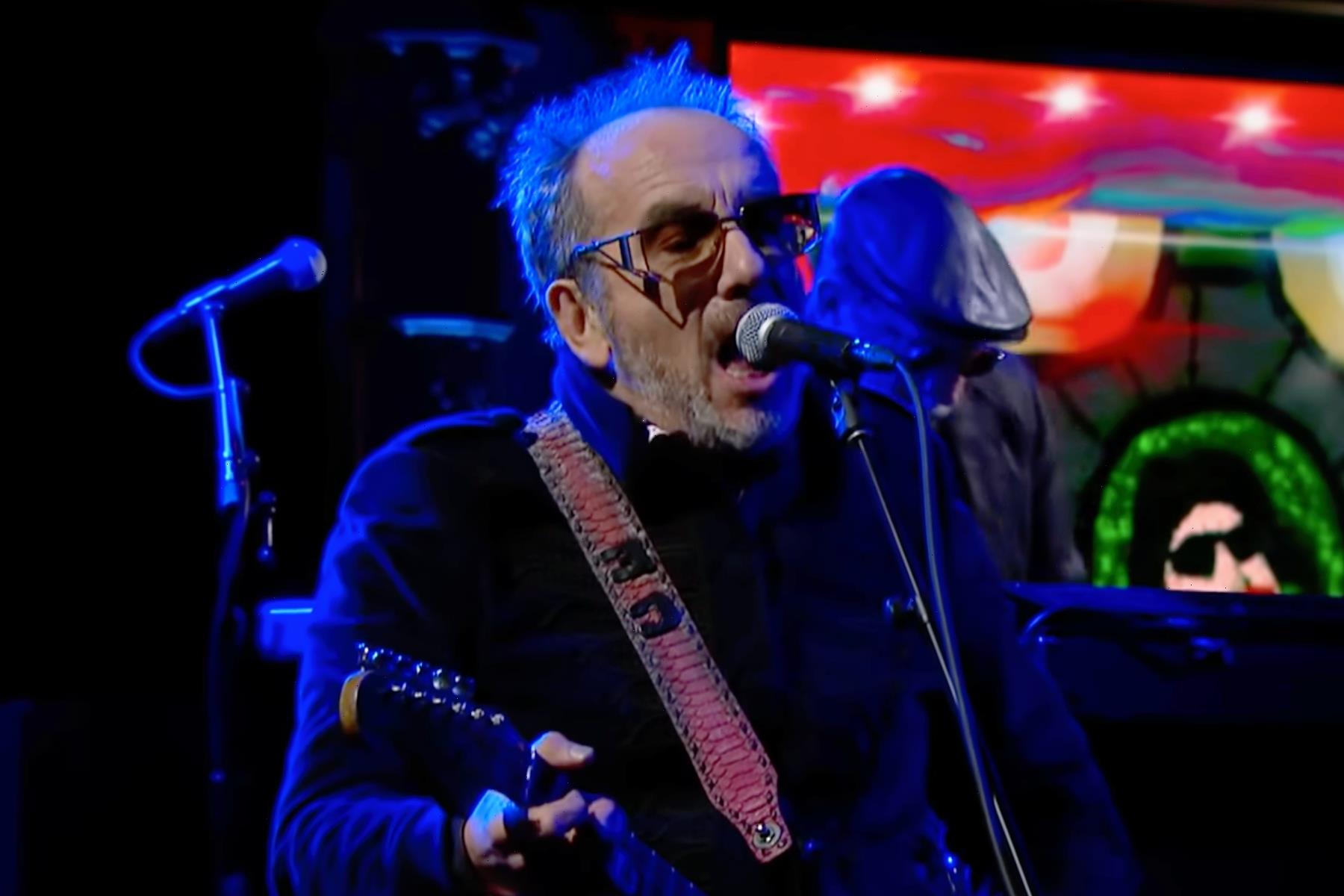

‘Rumors that we are halting all production of bikes and Treads are false,’ co-founder John Foley (pictured) said in response to the leaked memo

It is unknown how many products are currently sitting in warehouses.

Co-founder John Foley attempted to quash the damaging ‘rumors’ in a statement, saying: ‘Rumors that we are halting all production of bikes and Treads are false.’

He added that the company had ‘experienced leaks’ this week ‘containing confidential information that have led to a flurry of speculative articles in the press’.

But he said this information was ‘incomplete, out of context and not reflective of Peloton’s strategy,’ adding that the leaker had been identified and legal action will be launched.

Last May, the company had announced it was building a $400 million warehouse in Ohio to speed up production, but the facility isn’t expected to be ready until 2023. The company has since declined $40 billion in value.

The revelations prompted the share prices to plummet to $24.22 on Thursday, a two-year low

Foley tried to quash the damaging ‘rumors’ after a leaked presentation revealed the company has seen a ‘significant reduction’ in demand for the products

John Foley’s letter to staff in full

Team,

We have always done our best to share news with you all first, before sharing with the public. This week, we’ve experienced leaks containing confidential information that have led to a flurry of speculative articles in the press. The information the media has obtained is incomplete, out of context, and not reflective of Peloton’s strategy. It has saddened me to know you read these things without the clarity and context that you deserve.

Before I go on, I want all of you to know that we have identified a leaker, and we are moving forward with the appropriate legal action.

But moving forward, I want to take a moment to talk about some of the changes with you directly.

As a public company that is in a pre-earnings “Quiet Period” we are limited in what information we can share. However, we issued a pre-earnings press release earlier this evening about our preliminary Q2 results, in order to offer an initial and more accurate picture of our business performance.

As you have heard me and other leaders say over the past few months, we are continuing to invest in our growth, but we also need to review our cost structure to ensure we set ourselves up for continued success, while never losing sight of the important role we play in helping our 6.2+ million Members lead healthier, happier lives.

What this means for our team right now

In the past, we’ve said layoffs would be the absolute last lever we would ever hope to pull. However, we now need to evaluate our organization structure and size of our team, with the utmost care and compassion. And we are still in the process of considering all options as part of our efforts to make our business more flexible.

This team is made up of some of the smartest, most passionate, hard-working and KIND people I have ever met. You have each painted your masterpiece at Peloton in your own way, and your contributions matter. They always have, and they always will.

I am SO proud of everything we have accomplished together, and it pains me we are faced with these tough decisions. | know this is difficult, and I want to thank you for your patience as we work through these times together.

Rumors that we are halting all production of bikes and Treads are false

Notably, we’ve found ourselves in the middle of a once-in-a-hundred-year event with the COVID-19 pandemic, and what we anticipated would happen over the course of three years happened in months during 2020, and into 2021.

We worked quickly and diligently to meet the demand head-on at a time when the world really needed us, in large part thanks to how hard you worked every day. We feel good about right-sizing our production, and, as we evolve to more seasonal demand curves, we are resetting our production levels for sustainable growth.

Connected Fitness is here to stay

This past quarter, our churn rate was 0.79%. This means that our Members are sticking with us, again thanks to your brilliance and continued innovation. Connected fitness provides the convenience people need to stay active and centered and will continue to be a key part of the future of fitness. In fact, just a few days ago, we recorded our highest ever number of daily workouts — over 2.9M workouts.

I want to acknowledge that this does not answer all of the questions I am sure many of you have right now. But, I did want to share what we could at this time. I know there is a lot of noise and anxiety in our environment right now, which is why I wanted to take this moment to provide some additional context for you all as we navigate the next few weeks together.

In 2020, the company saw a 440 percent increase in shares, but saw it dramatically dropped 76 percent in 2021 as COVID lockdowns ended and gyms reopened.

In December 2020, the company’s stock hit an all-time high of $151.72 after many customers wanted to continue working out from their homes following many brick-and-mortar gyms temporarily closing due to COVID – but that trend has since reversed.

It put the company at a $45.7 billion value, and it couldn’t keep up with pandemic demand, as customers waited months for products.

Once a pandemic darling, Peloton has seen a slump in demand for its fitness classes and equipment as people venture out of their houses to hit gyms again.

The company initially set expectations too high for the third and fourth quarters and had to re-evaluate on December 14, dropping the expected sales on the Bike, Bike+, and Tread ‘significantly,’ according to CNBC.

However, the company’s presentation reportedly does not take into account the upcoming fee change for delivery and setup – which will be between $250 to $350, depending on the product – which will change at the end of the month, CNBC reported.

In addition, the company isn’t getting much traction for its upcoming ‘Project Tiger’ – or formally known as Peloton Guide – a $495 package consisting of strength training products and programs, which has since made the company realize it will face a ‘more challenging post-COVID demand environment.’

Project Tiger was initially set to be released last October, but has been pushed back to February and could be further delayed to April. The company also decreased the original price of $595 by $100.

Like sales, the company saw a decline in subscribers, with only 2.5 million in the last quarter – 161,000 were new users – but it was the lowest growth in two years.

The scandal-ridden company has seen its stock prices change drastically throughout the year as it has found itself embroiled in bad press.

In May last year, the company was forced to recall 125,000 treadmills following reports of multiple injuries and the death of a child in an accident. U.S. regulators are investigating the company over the injuries.

Peloton received 72 additional complaints of adults, kids and pets being pulled under the back of the treadmill, resulting in 29 injuries, the Consumer Product Safety Commission (CPSC) said.

The safety agency also released a video that showed how a person could become trapped by the device.

In November, it slashed its full-year outlook by up to $1 billion with analysts warning about a tough path was ahead.

The first episode of the highly anticipated reboot And Just Like That also didn’t shine a great light on the company after Mr. Big died of heart attack on one of the company’s bikes in the show

Mr. Big was killed off in the premiere episode of the Sex and the City reboot, And Just Like That after suffering a heart attack following a workout on a Peloton bike

Peloton was also the subject of a Sex and the City reboot And Just Like That episode last month that suggested the company’s exercise bikes could be lethal.

Carrie Bradshaw’s husband, Mr. Big, slumped to the ground moments after wrapping up a cycle session with his favorite instructor. He died of a heart attack in the episode.

Peloton later retorted that its equipment did not contribute to the fictional character’s death, which it blamed on his cigar-smoking and unhealthy diet.

Peloton later responded with a parody ad of its own, but retracted the ad after actor Chris Noth, who plays Mr. Big, was accused of sexual assault.

The company also announced earlier this week that it is considering closing 20 percent of its showrooms after slashing its full-year outlook by $1 billion.

One executive said 15 of Peloton’s 123 showrooms ‘are on the line’ as the company seeks to trim expenses.

Management during a recent call discussed asking employees at retail stores to take on more responsibilities by manning customer service lines when they’re not busy in the store, CNBC reported.

Peloton is set to release its second-quarter figures on February 8.

DailyMail.com has reached out to Peloton for a comment.

Source: Read Full Article