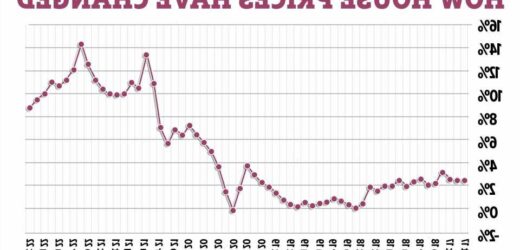

HOUSE prices fell in September following the fallout from Kwasi Kwarteng's mini-Budget.

Across the UK, house prices fell by 0.9% in October, according to the figures from Nationwide.

The annual rate of house price growth also slowed to 7.2% in October down from 9.5% in September.

A typical UK property now costs £268,282, according to Nationwide's index – down from £272,259 in September.

The news comes after mortgage rates hit a 14-year high last month.

Mortgage rates rose substantially as the number of deals on the market nosedived following Kwasi Kwarteng's mini-Budget last month.

READ MORE IN MONEY

Millions face higher mortgage bills as Bank of England set to up interest rates

Brits face YEARS of tax rises as Rishi Sunak tries to balance the books

The fall-out from the mini-Budget led sent the pound plummeting against the dollar to a low of $1.03 on September 26.

And it led the Bank of England to warn that interest rates would rise to 6% next year.

The average two-year-fixed mortgage rate hit a 14-year high on October 20 at 6.65%.

And average five-year fixed mortgage rate peaked at 6.51% last month.

Most read in Money

Millions of Brits eligible for huge £750 boost as 2 payments sent from TODAY

We tested hot water bottles… and the winner was better than Boots

Tesco takes extreme action to stop shoppers bagging all reduced items

I survive on 1 meal to make sure my boys are fed… I struggle to afford Netflix

And soaring mortgage rates slash the amount that buyers can afford to borrow – causing house prices to drop as fewer people opt to move.

Commenting on the house price figures, Robert Gardner, Nationwide's chief economist, said: "October saw a sharp slowdown in annual house price growth, to 7.2% from 9.5% in September.

"Prices fell by 0.9% month-on-month, after taking account of seasonal effects, the first such fall since July 2021 and the largest since June 2020.

“The market has undoubtedly been impacted by the turmoil following the mini-Budget, which led to a sharp rise in market interest rates.

"Higher borrowing costs have added to stretched housing affordability at a time when household finances are already under pressure from high inflation.

Stamp duty cuts, housing shortages, rising interest rates and higher mortgage borrowing costs are likely to lead to "downward pressures" on house prices in the months ahead.

But Rightmove's latest House Price Index suggests that the average price of properties coming to the market rose by 0.9% in October.

And figures from Rightmove suggest that the average house price hit a new record of £371,158 in October.

The Sun also reported that lenders are beginning to cut mortgage rates as the appointment of Jeremey Hunt as Chancellor and Rishi Sunak as PM has brought new stability to the markets.

Halifax said that house prices fell in September as the annual rate of growth slowed to 9.9%.

A typical UK property cost £293,835 in the same month, according to Halifax’s index.

Halifax will release its October house price index on Monday, November 7 and it's expected to follow the same trajectory as Nationwide's.

The Office For National Statistics (ONS) also releases regular figures on house price data.

But its most recent figures cover the period before the mini-Budget in August when house prices rose by 13.6% over the year.

The ONS is also expected to release its monthly house price index for September and October in November and December.

What will happen to house prices?

At the height of the mini-Budget turmoil Credit Suisse warned that house prices could fall by 15% next year.

Such a decline in property prices could result in the number of homes sold each year collapsing from 1.2million to just 800,00.

However, mortgage rates have fallen after hitting a 14-year high, bringing some relief to homeowners over the last week.

The news comes after the markets reacted positively to Rishi Sunak's appointment as Prime Minister.

And the expectation of the Bank of England raising the base rate to 6% has been scaled back to less than 5% – allowing lenders to slash their borrowing costs.

In fact, the average two-year-fixed mortgage rate is now down by 0.15% points on last week from 6.65% to 6.5%, according to MoneyFacts.

Average five-year fixed mortgage rates are also down by 0.15% points from 6.51% to 6.36%.

As borrowing costs stabilise, falling house prices also begin to level.

And experts in the field, including Nick Morrey of Coreco, argue that because the UK has a low supply of housing, predictions that house prices may collapse should be taken with a pinch of salt.

Ben Thompson of the Mortgage Advice Bureau previously told The Sun: "The most likely scenario as things look today, is that demand falls back from current levels and we do see a flattening off in house prices from now onwards, and probably single-digit falls on and off for a few months."

Nathan Emerson, chief executive of Propertymark said: "The potential for a softening of prices isn’t as terrifying as it sounds if we remember that prices have inflated by nearly 20% over the last two years."

How does it affect my finances?

How will it affect homeowners?

hey be in negative equity (depends when they bought and how much price changes, how long they live there, eg can they ride it out).

The majority of homeowners are on fixed-rate mortgage deals and over a million homeowners could be in for a bill shock next year when they're forced to eventually come to take out a new mortgage.

The Sun has already explained what you should do after mortgage rates shot up.

There are now fewer fixed mortgages to choose from, and rates will rise – meaning some may experience a drop in affordability, making it harder to get top rates.

If you're wondering whether to fix early now ahead of expected rate hikes, then you'll need to figure out whether it is worth doing so if you have to pay an early repayment charge.

Lenders slap this charge on borrowers if they leave their deal early – it can be up to 5% of your remaining balance, which could be thousands of pounds.

Use a calculator like the one offered by Nous, the cost of living website, which helps you work out if it’s cost-effective to refix early.

In any case, you should seek professional advice from a mortgage broker.

How will it affect first-time buyers?

On paper, a fall in house prices should mean that first-time buyers will need a smaller deposit to buy.

However, because mortgage rates remain high, any savings from a fall in house prices could be lost when it comes to mortgage costs.

If you're a first-time buyer you'll need to look carefully at your budget to see if you can definitely afford to take on a mortgage now.

There are now fewer deals on the market to choose from – and less chance for you to shop around for the best one.

But John Charcol mortgage technical manager Nick Mendes previously told The Sun that a drop in house prices as demand cools could bring some good news for first-time buyers.

He said: "It will be welcome news to first-time buyers who have seen property prices increase month on month for the past two years," he said.

"But with property prices increases over the last year and wages not keeping up with inflation and rates rises, many first-time buyers could be holding back on any plans and wait to see how things settle before jumping into one of the largest commitments in a mortgage."

Source: Read Full Article